Feeling fatigued from trading spots and derivatives in the crypto market? Or are you a DeFi veteran looking to explore additional TradFi trading experiences? In this article, we will introduce the innovative Zomma Protocol in the zkSync era, offering high capital efficiency and non-linear returns.🔥

(know more about zkSync ecosystem: Exploring the zkSync Ecosystem! Top 8 Dapps Introduction)

TL;DR

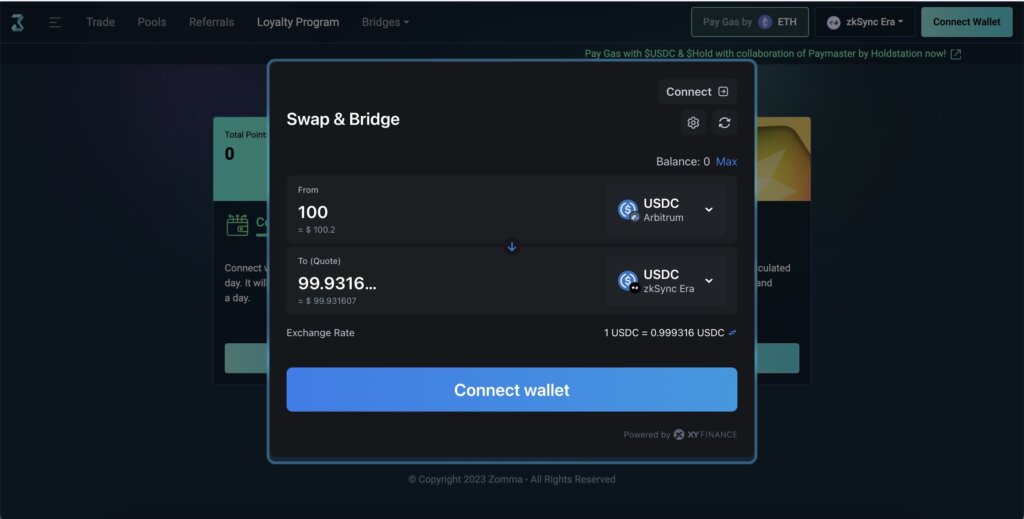

- XY Finance is now supercharging Zomma’s DeFi Options platform with our advanced cross-chain solutions on Ethereum, zkSync Era, Linea, Base, Polygon zkEVM, Arbitrum, Optimism, BNB, Polygon, Avalanche, Fantom, Scroll, Blast!🔥

- Zomma stands at the forefront of zkSync, redefining DeFi Options with a TradeFi trading experience, along with ultimate capital efficiency.

- Together, we present to you streamlined swaps of any tokens across 20+ EVM chains via XY Finance on Zomma seamlessly🌐

XY Finance x Zomma Protocol

We’re thrilled to announce that Zomma, the cutting-edge and the 1st options protocol launchpad on zkSync, has integrated the XY Finance cross-chain widget! This integration enables Zomma users to seamlessly access tokens from 20+ chains, empowering them to participate flexibly in both buying and selling options calls and puts on the Zomma platform.

By incorporating the XY Finance cross-chain widget, Zomma aims to enhance liquidity, attract new users, and broaden its reach to a diverse, multi-chain audience.🤝

About Zomma Protocol

Zomma is the first DeFi options protocol on zkSync that merges DeFi options with TradFi features, providing on-chain European options trading. Zomma aims to democratize options trading by providing a comprehensive platform suitable for beginners to pros. Its trading experiences encompass buying and selling ETH options, as well as features such as staking, yield mining, settlements, and minimal collateral requirements. The following are essentials of Zomma for you:

- Enhanced ETH-Free trade:Zomma has integrated Paymaster by zkSync and joined Holdstation’s Paymaster Alliance, enabling users to pay gas fees with $HOLD & $USDC and enhancing the ETH-Free trading experience for users.

- High Capital Efficiency:One of the features of derivatives compared to spot trading is capital efficiency, meaning using less money to attain the same rewards, albeit with higher risk. Zomma Protocol, offering DeFi options, not only allows users to earn non-linear rewards but also builds multiple staking pools based on their own risk tolerance.

- Stability and Safety:Zomma uses the distinct ZLM (Zomma Liquidation Mechanism), liquidating pools when the health factor falls below 0.5. This not only extends stability but also guarantees the security of the platform, protecting everyone’s hard-earned money.

About LPs:Not only trade, stake in pools for earnings as well

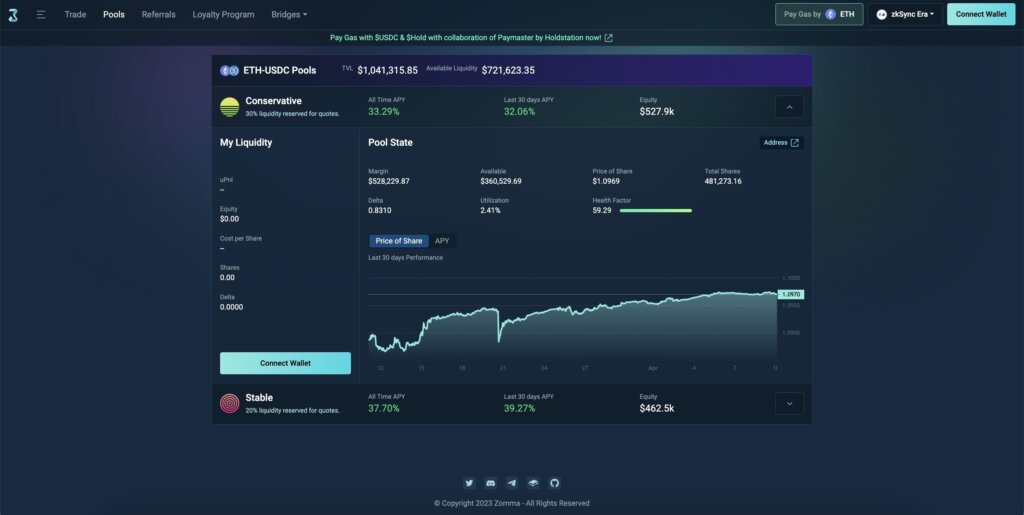

In order to address the liquidity and potential capital inefficiency of the options market in TradFi, Zomma offers liquidity pools with different leverages. The operational mechanism, similar to the popular derivatives protocol GMX, enables users to trade against the pool and automatically earn transaction fees. Now Zomma provides two kinds of liquidity pools based on different levels of safety and earning yields:

- Conservative Pool:This pool reserves 30% of liquidity, leaving 70% for quoting and trading with options traders. As its name suggests, it undertakes a relatively conservative approach by locking more money in the pool.

- Stable Pool:This pool reserves only 20% of liquidity, leaving 80% for quoting and trading with options traders. With this pool, you undertake higher risk but still at a moderate level.

In summary, if the pool allocates a higher proportion for trading against users, the risk of loss and liquidation opportunities increase. Therefore, DYOR before participating.

More About Zomma Protocol

Website | Twitter | Telegram | Discord

What is XY Finance & Cross-Chain Widget?

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges.

For users

XY Finance provides cross-chain solutions in which users can bridge and swap any tokens seamlessly across all the chains we currently support. As of the time of writing, XY Finance has integrated 20+ chains, 280+ DEXs and 270k+ tokens!

For users, try out Swap to bridge & swap with the most seamless cross-chain experience

For developers

XY Finance’s cutting-edge APIs & widgets help power cross-chain bridging and swapping solutions that enable projects to connect with various chains and networks to inflow more liquidity and create more new use cases. Let us do the work so you can sit, relax and on board more multi-chain users!

Ready to hop into the multichain world & engage more users on 20+ chains

👉 Introducing XY Finance Cross-Chain Widget

👉 Widget Integration Developer Document

Supporting promising projects like Zomma to expand its outreach from zkSync to the multi-chain space is what we do at XY Finance and we can’t wait to onboard more projects & users to the multi-chain world with XY Finance cross-chain widget!

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form