Following the launches of Arbitrum and Optimism, zkSync is now a prominent contender in the leading Layer 2 (L2) game. After zkSync 2.0 launch in March 2023, its ecosystem has spawned over 300 protocols, and the TVL has exceeded 100 million in a short time. This article will give you a comprehensive understanding of the development history and features of zkSync, and step-by-step guide you into the zkSync ecosystem!

(You would like to know: Step-by-Step Guide to Qualify for Potential zkSync Airdrop!)

What is zkSync?

zkSync is a Layer 2 scaling solution designed to enhance Ethereum’s scalability. It achieves this by leveraging innovative technology known as zero-knowledge proofs (zk-Proofs) to provide more affordable and faster transactions compared to Ethereum mainnet.

The “zk” in zkSync stands for “zero knowledge,” while “rollups” refer to smart contracts. These smart contracts efficiently consolidate numerous transactions from the primary Ethereum layer into a single transaction, optimizing efficiency and cost-effectiveness.

One of the remarkable features of zkSync is its use of zero-knowledge proofs, which ensure robust cryptographic security. Through this technology, zk-Rollup solutions validate transaction integrity without revealing the underlying evidence, enhancing privacy and security. With zkSync, Ethereum’s scaling capabilities are significantly enhanced, offering users faster and cheaper transactions while preserving the blockchain’s core security and finality.

Who’s behind zkSync?

Matter Labs, the developer behind zkSync, secured funding from prominent sources like the Ethereum Foundation, Dragonfly Capital and Union Square Ventures. Matter Labs initiated the project in 2019, culminating in the release of zkSync Lite in 2020. In the following sections, we will provide a comprehensive overview of zkSync’s development.

The Evolution of zkSync: From Lite to Era

zkSync has undergone significant transformations, from zkSync Lite to the zkSync Era, each iteration marking a milestone in the quest for a more efficient Ethereum.

zkSync Lite (zkSync 1.0)

zkSync Lite can be regarded as the inaugural version of zkSync, released in mid-2020. It was primarily designed to facilitate payment transactions and was capable of processing up to 3,000 transactions per second (TPS).

However, the increasing demand for higher network throughput, along with the need for smart contract support, has driven developers to continue advancing new technologies, pushing zkSync to a new peak.

zkSync Era (zkSync 2.0)

In March 2023, the zkSync team launched the zkEVM mainnet, zkSync Era. As the name suggests, it is a zk-rollup that is compatible with EVM. Developers can directly use Solidity or other Ethereum languages to develop smart contracts in the zkSync ecosystem, significantly lowering the entry barrier and migration costs of zkSync.

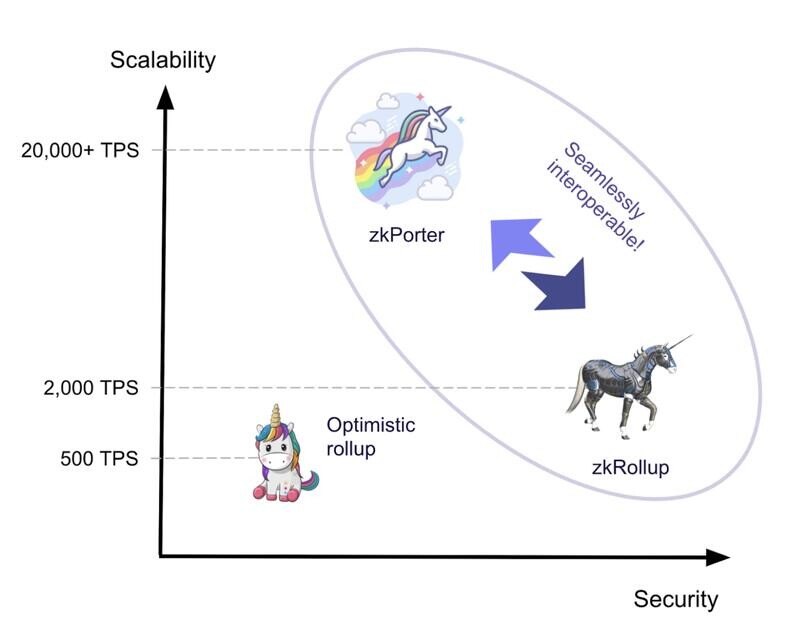

zkPorter

Moreover, zkPorter is also a major highlight of the zkSync Era. It is a chain-based sharding solution that stores data off-chain and uses ZKP to validate transactions. This sharding approach can significantly improve the transaction throughput of zkSync and bring its TPS to over 20,000.

zkSync vs. other L2 solutions

Ethereum L2 scaling solutions are thriving, with many viewing L2 as the highlight of the next bull market. Among them, including Optimism, Arbitrum, Polygon zkEVM, and zkSync, each has its strengths and weaknesses, with no one being superior to the others.

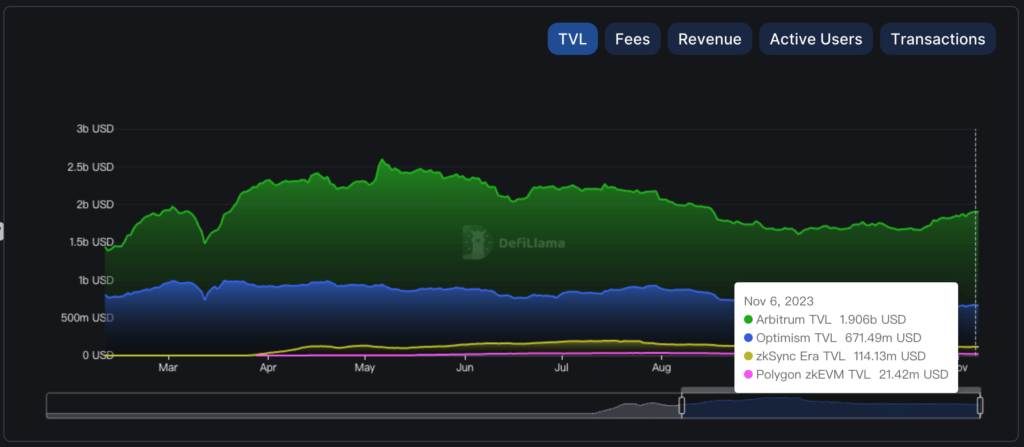

According to DeFiLlama, the TVL rankings of these L2 solutions are as follows:

- Arbitrum

- Optimism

- zkSync Era

- Polygon zkEVM

Despite its third-place ranking, zkSync remains the most popular zk-rollup in the market. The significant difference in TVL compared to Arbitrum and Optimism may be attributed to their earlier launch times and the more developed ecosystems they possess.

Comparative Analysis of L2 Solutions

From the table below, it’s evident that zkSync boasts higher TPS compared to other L2 solutions. It also exhibits lower withdrawal times and transaction costs compared to the other two Optimistic Rollup L2s.

However, on the flip side, zkSync’s EVM compatibility is relatively lower than other L2 solutions, and there are more limitations on supported Smart Contracts. This is an aspect developers should take note of.

| Feature | Optimism | Arbitrum | Polygon zkEVM | zkSync Era |

| Rollup Type | Optimistic | Optimistic | zk-Rollup | zk-Rollup |

| Consensus Mechanism | Optimistic | Optimistic | zkSNARKs | zkSNARKs+zkSTARKs |

| EVM Compatibility | Yes | Yes | Yes | Partial |

| Smart Contract Support | Yes | Yes | Yes | Limited |

| Transactions Per Second | 2,000 tps | 4,500 tps | 20,000 tps | 20,000 tps |

| Withdrawal Times | 7 days | 7 days | within hours | within hours |

The optimal choice depends on your project’s specific needs, like transaction speed, security, and smart contract compatibility. As both zk-Rollups and Optimistic Rollups, along with these four protocols, continue to develop, it’s essential to stay informed and adapt to leverage Ethereum L2 rollups for a more scalable, secure, and cost-efficient blockchain ecosystem.

Need to know that there is no definitive “best” L2 solution among these options; everything depends on users’ specific use cases and requirements.

zkSync’s Pros and Cons: Could it be the major scaling solution for Ethereum projects?

Here, we’ll summarize the pros and cons of zkSync and evaluate whether it has the potential to become a primary scaling solution on Ethereum in the future.

Pros

- Scalability: zkSync employs zk-rollup technology, enabling high transaction throughput and reduced gas fees compared to the Ethereum mainnet.

- Decentralization: Utilizes randomly selected validators to prevent single-entity control.

- Security: ZKPs ensure off-chain validation, mitigating censorship attacks.

- Privacy: Offers strong privacy by keeping transaction details private with ZKPs.

- Developer Ecosystem: Provides a developer-friendly environment with SDKs, APIs, and documentation.

Cons

- Complexity: Implementing ZKPs can be complex and resource-intensive, requiring specialized knowledge and significant computational resources.

- Rewriting Contracts: Smart contracts might need to be rewritten in a specific language for zk-rollup compatibility.

- Initial Barrier: Initial implementation costs of ZKPs can pose a barrier for some projects.

Future Outlook

zkSync is a promising Ethereum scaling solution. Its strengths in scalability, security, and privacy are attractive. However, complexity and initial barriers could impact adoption. zkSync’s future as Ethereum’s primary scaling solution depends on development, community adoption, and competition from solutions like Optimistic rollups. Though predicting the future is hard, zkSync’s features and improvements suggest a vital role in Ethereum’s scaling landscape.

AirDrop is on the Way!

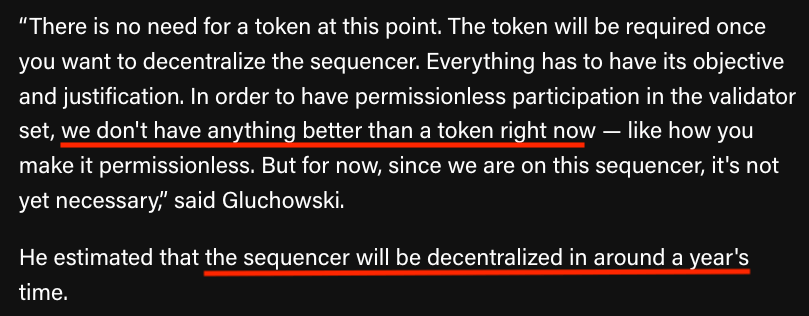

In addition to the advantages mentioned above, zkSync has a huge potential profit for users: zkSync’s token has not yet been airdropped!

According to an interview with Matter Labs CEO Alex Gluchowski by The Block in March 2023, he stated that they don’t have anything better than a token to decentralize the sequencer, and it is estimated to take one year for zkSync to reach this stage.

Therefore, we can expect to receive zkSync airdrop rewards around March next year!

Based on CoinMarketCap’s price data, a single address can earn up to about $43,000 and $12,000 in Optimism and Arbitrum airdrop, respectively. If you don’t want to miss out on such an incredible opportunity to get rich, starting to explore the zkSync ecosystem now is your best choice.

(Your Step-by-Step Guide to Qualify for Potential zkSync Airdrop!)

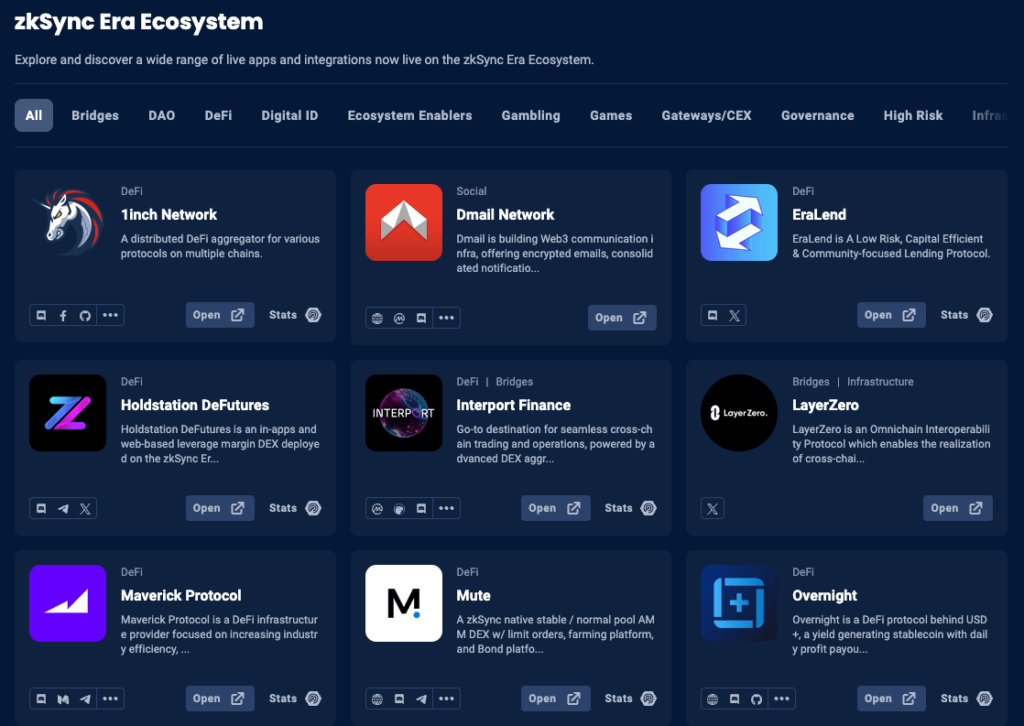

Ecosystem on zkSync

Since its launch in March 2023, the zkSync ecosystem has experienced rapid development. We have compiled a list of top projects for you to explore how far these initiatives have progressed and identify the leading applications with significant potential.

DEX&NFT – SpaceFi

SpaceFi is a cross-chain Web3 platform on Evmos and zkSync. Functioning as a multi-purpose hub for a variety of product modules, SpaceFi offers a diverse range of financial tools and services that cater to a broad spectrum of cryptocurrency users and enthusiasts.

(Read more About SpaceFi: https://blog.xy.finance/spacefi/)

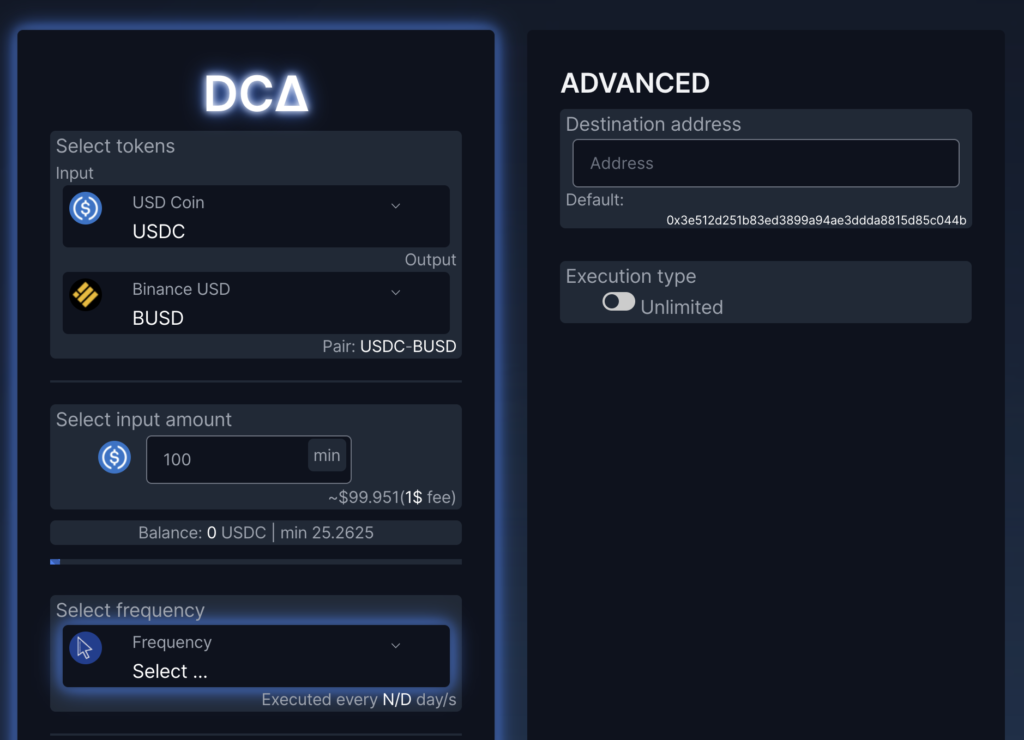

Tool – Neon Protocol

The Neon Protocol is a decentralized, automated, and non-custodial / no-deposit DCA (Dollar-Cost-Averaging) protocol, making DCA easy and accessible for everyone.

(Read more About Neon Protocol: https://blog.xy.finance/neonprotocol/)

DEX – Velocore

Velocore is the first ve(3,3) DEX of zkSync, built on the foundations of Solidity and Velodrome Finance.

(Read more about Velocore: https://blog.xy.finance/velocore/)

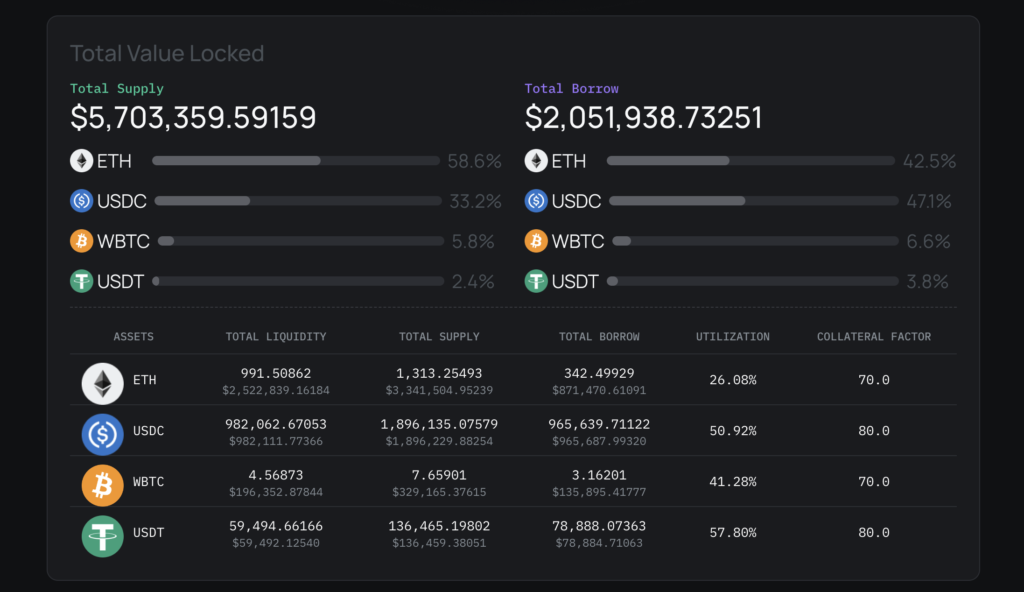

Lending – ReactorFusion

ReactorFusion is the top lending and borrowing market native to zkSync, it is based on Compound Finance and offers unique bribe-reward tokenomics.

(Read more about ReactorFusion: https://blog.xy.finance/reactorfusion/)

In addition to the protocols mentioned above, there are hundreds of other protocols on zkSync that are waiting for users to explore. These can all be found on the official zkSync ecosystem website!

How to bridge to zkSync?

After you have a basic understanding of zkSync and its ecosystem, it’s time to bridge your assets and explore freely!

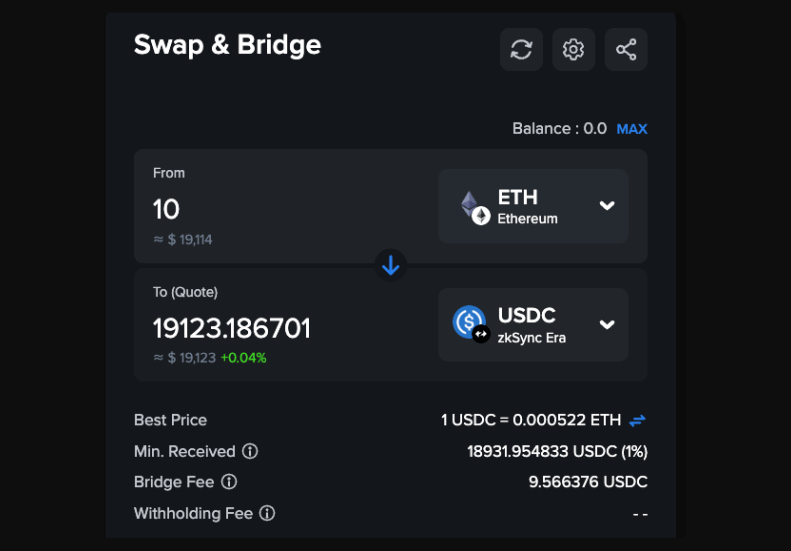

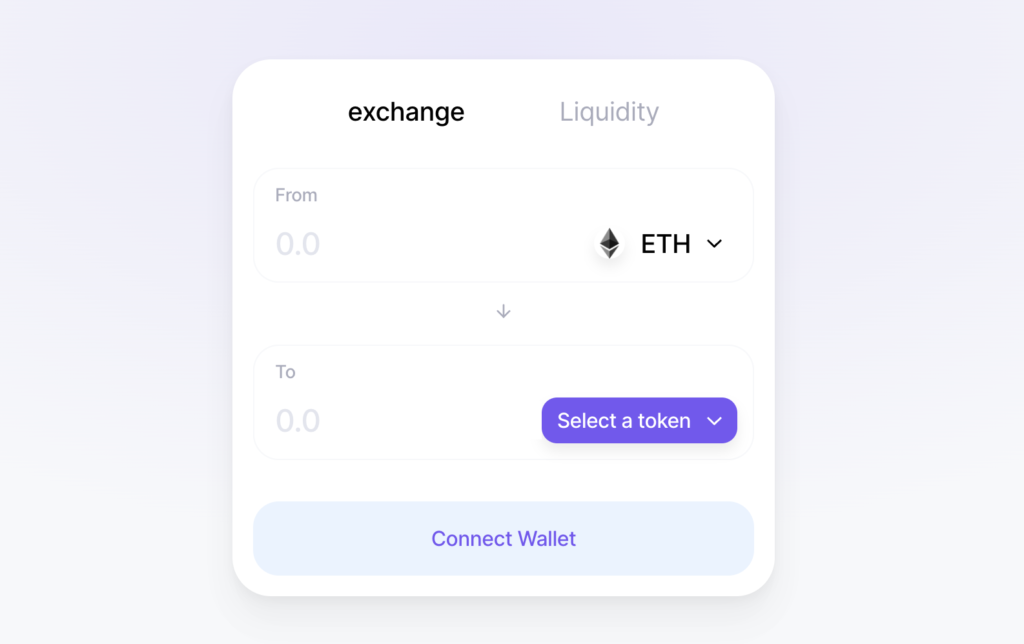

Bridging to zkSync is very simple thanks to the variety of secure bridges that connect zk-rollups to other Ethereum Virtual Machine (EVM) compatible chains. We recommend XY Finance because it offers ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

(Fully understand XY Finance: What is XY Finance? The cheapest cross-chain bridge aggregator that operates on 18 EVM chains)

You can bridge tokens to zkSync with this simple guide:

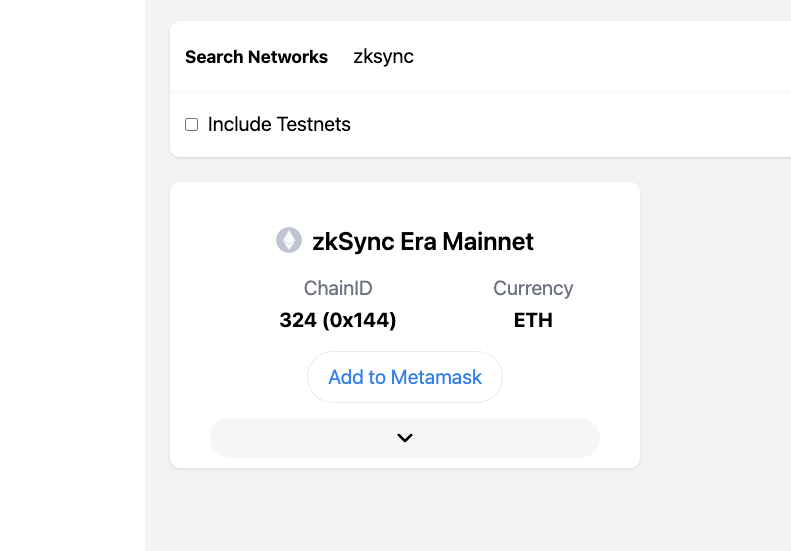

- Add zkSync Era to Metamask through Chainlist.

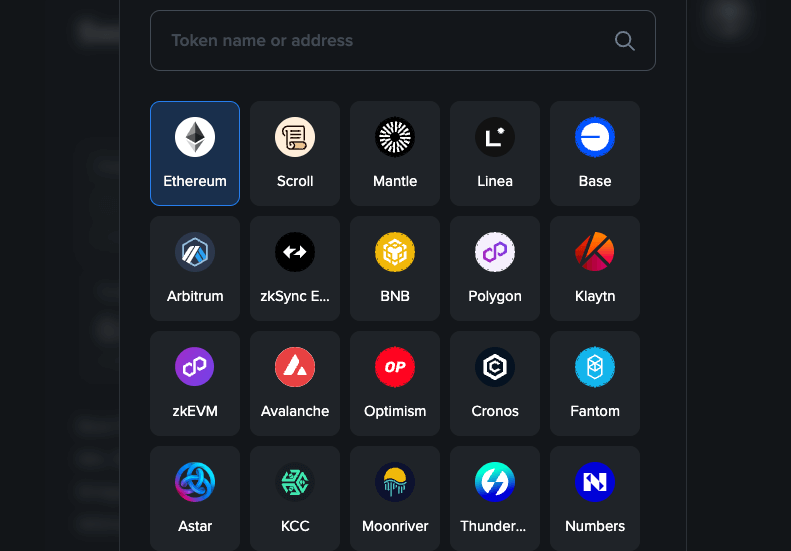

- Visit XY Finance and connect your MetaMask Wallet.

- Select the network you want to transfer tokens from (Ethereum, Polygon, Arbitrum, Avalanche, Optimism + 15 others).

- Select the token you want to bridge from your network to zkSync and input the amount.

- Review and confirm the transaction. Your tokens will arrive in under 5 minutes.

And now, everything is ready! Click the button and enjoy your surfing time in the zkSync universe!

Sources :

coingecko.com

defillama.com

thedefiant.io

AuroBlock

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form