TL;DR: Why Use XY Finance xAsset Bridge to Build Your Own Canonical Token Bridge:

- Wrap your tokens across diverse chains enabling assets to be sent, received, stored, and used on multiple blockchains.

- Deploy on every existing and future chain that XY Finance supports.

- 100% detachable bridge solution granting 100% complete ownership to partner.

- Separate bridge contracts for enhanced security.

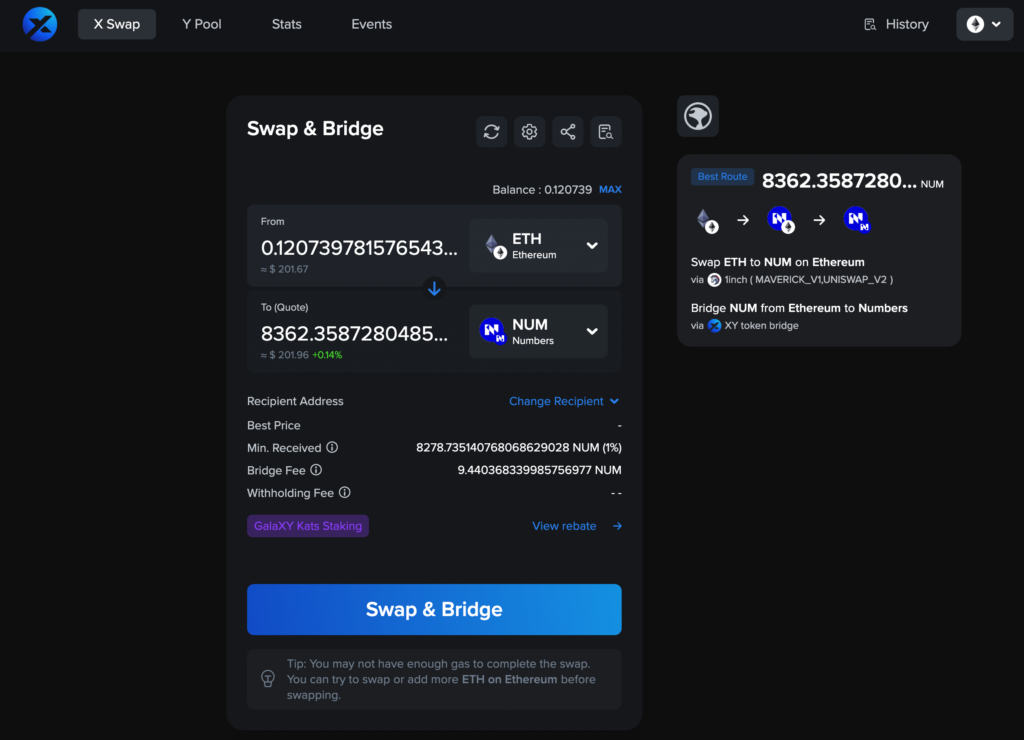

- Most simplified and user-friendly asset transfers via bridge aggregator integration. Increase token usage & expand your token to all EVM chains.

- Effortless liquidity management with mint/burn method.

Introducing XY Finance’s xAsset Bridge

In the rapidly evolving world of decentralized finance, cross-chain interoperability is the keystone to seamless integration and functionality. XY Finance, staying true to its commitment to innovation, has introduced its xAsset bridge, a pinnacle in cross-chain bridge technology, ensuring holders can swiftly and securely wrap their tokens across diverse chains.

The Essence of XY Finance’s xAsset Bridge – 100% Detachable Bridge Solution

Full Autonomy with Detachable Design: XY Finance’s xAsset Bridge stands out with its fully detachable nature. What does this mean for partners?

- 100% Ownership: All token contracts are deployed by partners.

- 100% Flexible: Ultimate control lies with the partners, who have the privilege to revoke XY Finance’s operational authority anytime. This translates to the freedom to replace bridge operators whenever deemed necessary.

- Independent & Without Systematic Risk: Each partner’s bridge contract is independent, eliminating any systematic risk and potential side effects from XY Finance.

- Hassle-Free in Maintaining Liquidity: The mint/burn method relieves partners from the hassle of maintaining liquidity pool balance. What’s more, xAsset Bridge won’t affect the overall supply of partner tokens.

Benefits of xAsset Bridge & Integration with XY Finance’s Bridge Aggregator

The xAsset Bridge brings forth multiple advantages as after integration, users can trade any tokens on all our 20+ supported chains to partner’s token:

- Partner’s token listed on XY Finance Swap

- Flash Buy-in partner’s token. Increasing accessibility and reducing entry barriers for users.

- Significant boost to token usage.

XY Finance xAsset Bridge facilitate the expansion of partners’ tokens to over 20+ EVM chains including zkSync, Linea, Arbitrum, Optimism, BNB, Polygon & beyond.

How Does It Work? XY Finance’s xAsset Bridging Methods

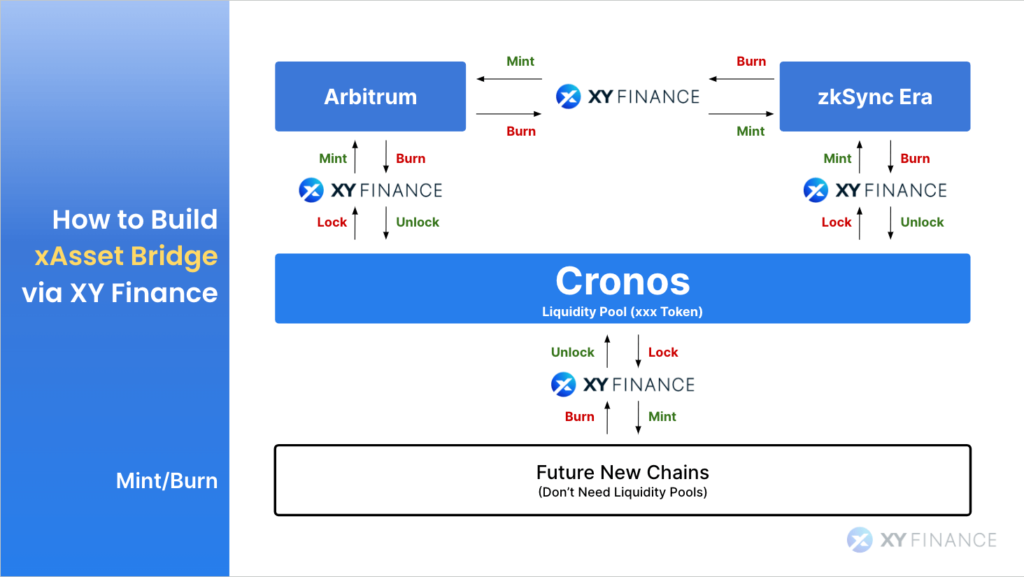

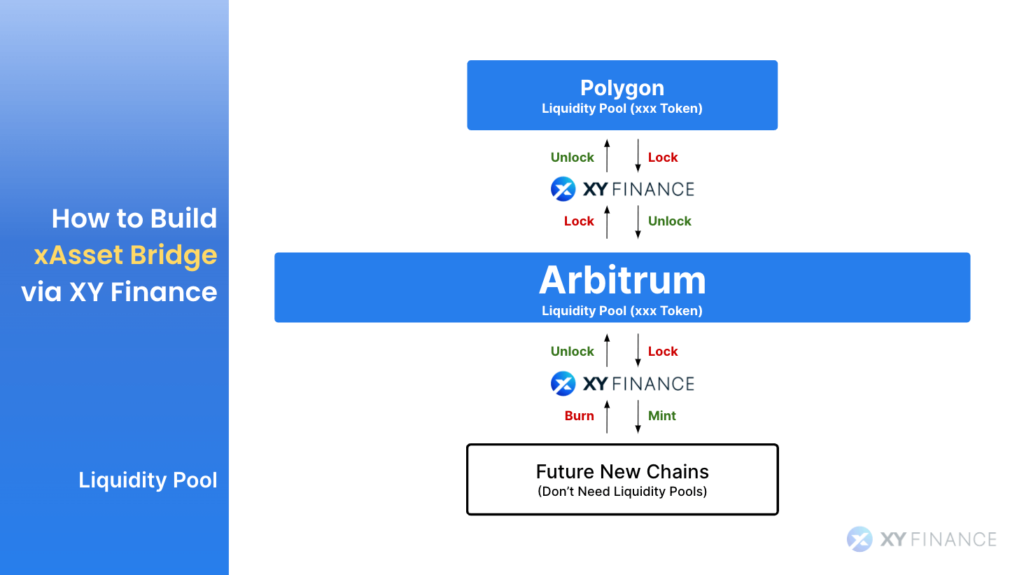

Understanding the diversity of needs and the complexity of the blockchain landscape, XY Finance offers two robust fungible token bridging methods:

- Mint & Burn Method: When users bridge their token using this method, the token interacts with the xAsset bridge in a mint/burn fashion. If the Mint & Burn approach is chosen, tokens transferred to other chains get sent to the xAsset bridge contract on the source chain and new tokens on the destination chain are minted. Conversely, when bridging back, the tokens are burned and dispatched to the user on the source chain.

- Pool-Based Method: Operational in a lock/unlock manner, tokens using this method will be locked in the xAsset bridge contract on the source chain while bridging to other chains and users will receive the unlocked token on the destination chain. Upon bridging back, they are seamlessly unlocked and returned to the user.

Which Bridging Scenario for Projects:

To determine the appropriate scenario and method for your project, please evaluate the following information to choose the scenario and method that best suits your needs:

- Mint & Burn Method: If your token is exclusive to one chain and you’re looking to deploy onto new chains:

- Pool-Based Method: If your tokens are already deployed on N chains and want to enable token cross-chain functionality on these N chains

- Combination of Both Methods: If your tokens are already deployed on N chains and you want to deploy tokens to a new chain and enable token cross-chain functionality on N+1 chains

A Leap Forward in Cross-Chain Interoperability:

The xAsset bridge not only empowers partners with complete ownership and autonomy but also fortifies security.

- Each partner enjoys a dedicated bridge contract, ensuring their assets remain protected and isolated from external threats.

- Liquidity management, a commonly perceived challenge, is made effortless, thanks to the mint/burn mechanism.

- Furthermore, as mentioned above, the synergy between XY Finance’s xAsset Bridges and the bridge aggregator means users benefit from enhanced token usage and an optimized asset transfer process. This alignment embodies XY Finance’s mission to deliver a user-centric and streamlined cross-chain interoperability experience.

For more technical details including how to set up your own validator, deposit/withdraw liquidity

🔗 xAsset Bridge Developer Document

Interested in xAsset Bridge? Fill the form, our BD team will get in touch with you

🔗 Partnership Form

XY Finance’s commitment to streamlining cross-chain interoperability is evident in the features and flexibility of the xAsset bridge. Dive deep with us, and together, let’s redefine the future of cross-chain bridges.

FAQ:

How does xAsset Bridge charge fees?

💰 No integration fees, it’s FREE.

💰 When users utilize XY Finance in the future to bridge your project’s tokens, there will be a bridge fee incurred depending on the destination chain. For more information regarding fee structure from the user-end, you can refer to our document.

What security measures does xAsset Bridge have?

💎 100% Ownership: All token contracts are deployed by partners.

💎 100% Flexible: Ultimate control lies with the partners, who have the privilege to revoke XY Finance’s operational authority anytime. This translates to the freedom to replace bridge operators whenever deemed necessary.

💎 Independent & Without Systematic Risk: Each partner’s bridge contract is independent, eliminating any systematic risk and potential side effects from XY Finance.

These measures eliminate malicious incidents similar to Multichain (Previously known as Anyswap) or other systematic exploitation.

Which bridging method should my project use?

✅ Single chain wanting expansion: Mint & Burn.

✅ Multiple chains seeking cross-functionality: Pool-based.

✅ Expansion + cross-functionality: Combination of both.

If the token has taxes, can I integrate xAsset Bridge?

In the regular integration process, once you provide your token address to the XY Finance team, we will deploy the relay contract for the token bridge service. If your token involves transfer taxes, you need to whitelist the relay contract address as both the ‘sender’ and ‘receiver’ in order to exempt these taxes during the bridge process.

I am interested in xAsset Bridge integration, how do I start?

You can fill this partnership form and provide relevant information first, our BD team will get in touch with you to assist!

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form