What is ERC-404?

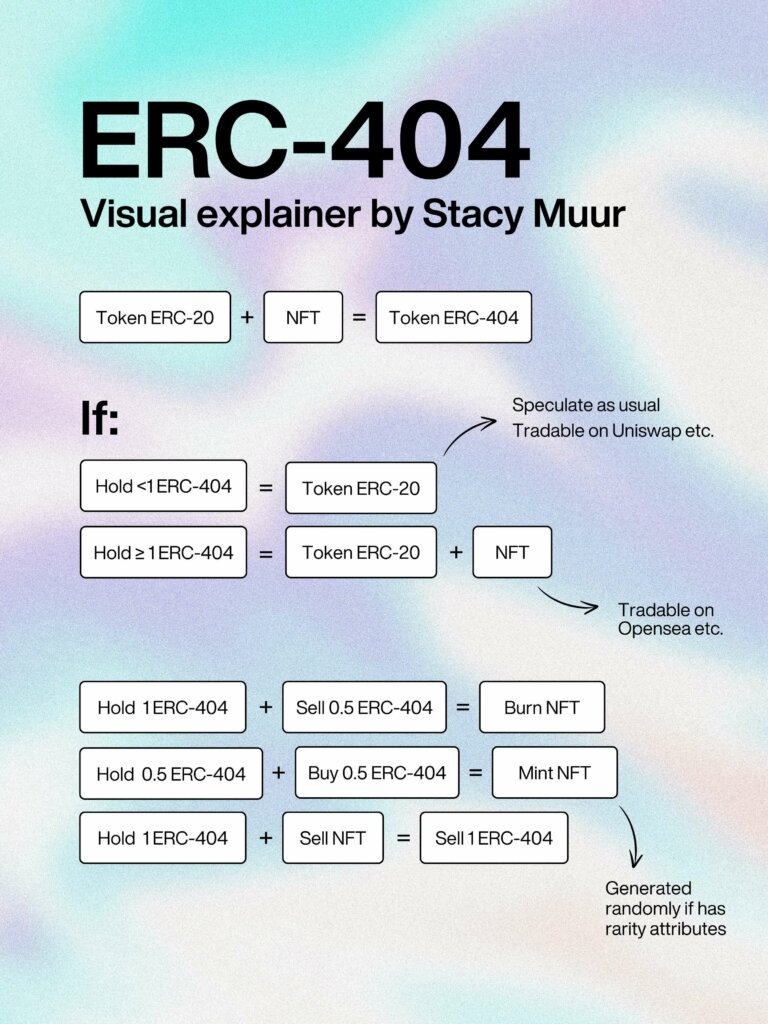

ERC-404, proposed by Acme, is an experimental token standard aiming to enhance the liquidity and composability of crypto assets. ERC-404 merges the features of ERC-20 (fungible tokens) and ERC-721 (non-fungible tokens), enabling tokens to be both fungible and non-fungible simultaneously.

Specifically, the process involves linking an ERC-721 token with an ERC-20 token, creating a scenario where the ERC-20 token symbolizes an NFT only when it remains undivided. As the ERC-20 token splits into fractions for transaction purposes, the original NFT is burned. Conversely, merging fractional pieces that complete a whole token results in the mint of a new NFT.

What problems does ERC-404 try to solve?

Before the advent of ERC-404, there were several unresolved issues with existing token designs that could not be addressed:

1. Liquidity fragmentation caused by asset types

ERC-20 and ERC-721 are the most prevalent types of crypto assets, requiring separate smart contract designs to accommodate their differences. For instance, Uniswap is designed exclusively for fungible tokens, rendering NFTs incompatible with its secure AMM trading contracts; conversely, OpenSea caters only to NFT trading and services.

2. Underutilization of NFT liquidity

Current smart contract designs do not facilitate stable and ample liquidity for NFTs, primarily relying on listing-based buying and selling methods.

Despite attempts by NFT lending and fractionation protocols to address this issue, they have not become mainstream, leaving liquidity challenges unresolved.

However, with the emergence of ERC-404, new solutions for these problems have become available.

Introduction to the Operation Mechanism of ERC-404

The ERC-404 mechanism uniquely integrates the features of both ERC-20 and ERC-721 tokens, automating the minting and burning of NFTs based on the quantity of ERC-404 tokens held. This integration offers both the convenience of fungible tokens and the uniqueness of non-fungible tokens.

For instance:

- When holding less than one ERC-404 token, it is considered purely as an ERC-20 and does not generate any NFTs (ERC-721), allowing for trading on DEXs like Uniswap.

- Possessing one ERC-404 token automatically mints a new NFT, which is bound to the ERC-20 token, enabling its trade not just on DEXs but also on NFT marketplaces such as OpenSea.

Therefore, when a holder sells some of their ERC-404 tokens, reducing their holding to less than one, the binding NFT is automatically burned. Conversely, when a holder acquires enough ERC-404 tokens to increase their holding to more than one, a new NFT, bound to the ERC-20 tokens, is automatically minted.

This mechanism implies that holding the ERC-721 token equates to owning the corresponding ERC-20 token, and selling the NFT is equivalent to selling the ERC-404 token.

For those still puzzled by the concept of ERC-404, Web3 developer Stacy Muur has created a visual explainer that offers a deeper understanding.

What New Possibilities Does ERC-404 Bring?

The advent of ERC-404 heralds a transformative era in blockchain technology by merging the unique attributes of NFTs with the versatility of fungible tokens. What changes will the market see?

1. Combining Uniqueness and Divisibility

ERC-404 tokens blend the distinct uniqueness of NFTs (each token has a unique ID and metadata) with the divisibility and liquidity of fungible tokens (allowing tokens to be freely transferred and divided into smaller amounts).

2. Enhancing Liquidity and Tradeability:

ERC-404 facilitates token division and trading on DEXs, significantly increasing NFT liquidity. Users don’t need to buy a whole NFT at once; they can make smaller, incremental purchases until they accumulate a full ERC-404 token, automatically minting the NFT.

3. Inspiring More Diverse Apps

ERC-404 tokens can interact with both ERC-20 and ERC-721 smart contracts, breaking previous limitations and enabling developers to create applications previously unachievable with existing standards.

ERC-404 vs ERC-20 vs ERC-721 vs ERC-1155

The Ethereum Request for Comment (ERC) outlines the interaction protocols for smart contract tokens with the Ethereum Virtual Machine. The ERC-20 standard, an early and widely used smart contract benchmark, facilitated the development of uniform token contracts. Recently, the rise of Non-Fungible Tokens (NFTs) has led to the broader adoption of the ERC-721 and ERC-1155 standards, specifically designed for NFT functionalities, marking a significant expansion in token standard applications.

The table outlines the key differences among four types of tokens:

| ERC-20 | ERC-721 | ERC-1155 | ERC-404 |

| Fungible | Non-fungible | semi-fungible | semi-fungible |

| Can be fractionalized | Cannot be fractionalized | Cannot be fractionalized | Can be fractionalized |

| Tradable on AMM DEXs and order book CEXs (Uniswap, Binance) | Tradable on NFT marketplaces (OpenSea, Blur) | Tradable on NFT marketplaces (OpenSea, Blur) | Tradable on all platforms mentioned previously |

ERC-404 Projects Introduction — Pandora, Sheboshis and DeFrogs

After learning about ERC-404, let’s explore some of the hottest ERC-404 projects on the market!

Pandora

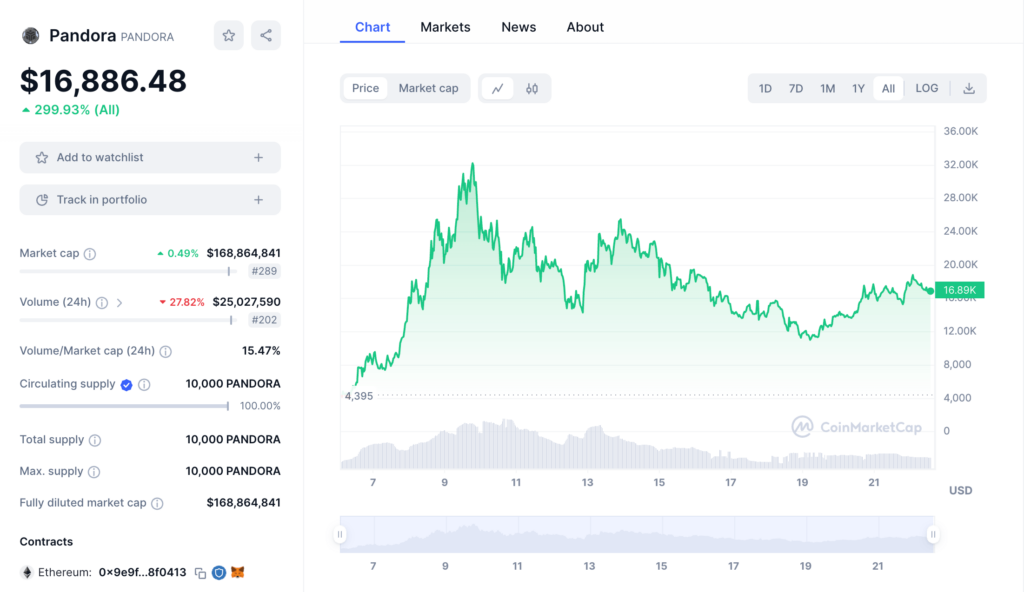

One of the first experimental ERC-404 projects launched by Acme and their team shortly after the introduction of the ERC-404 token standard is Pandora.

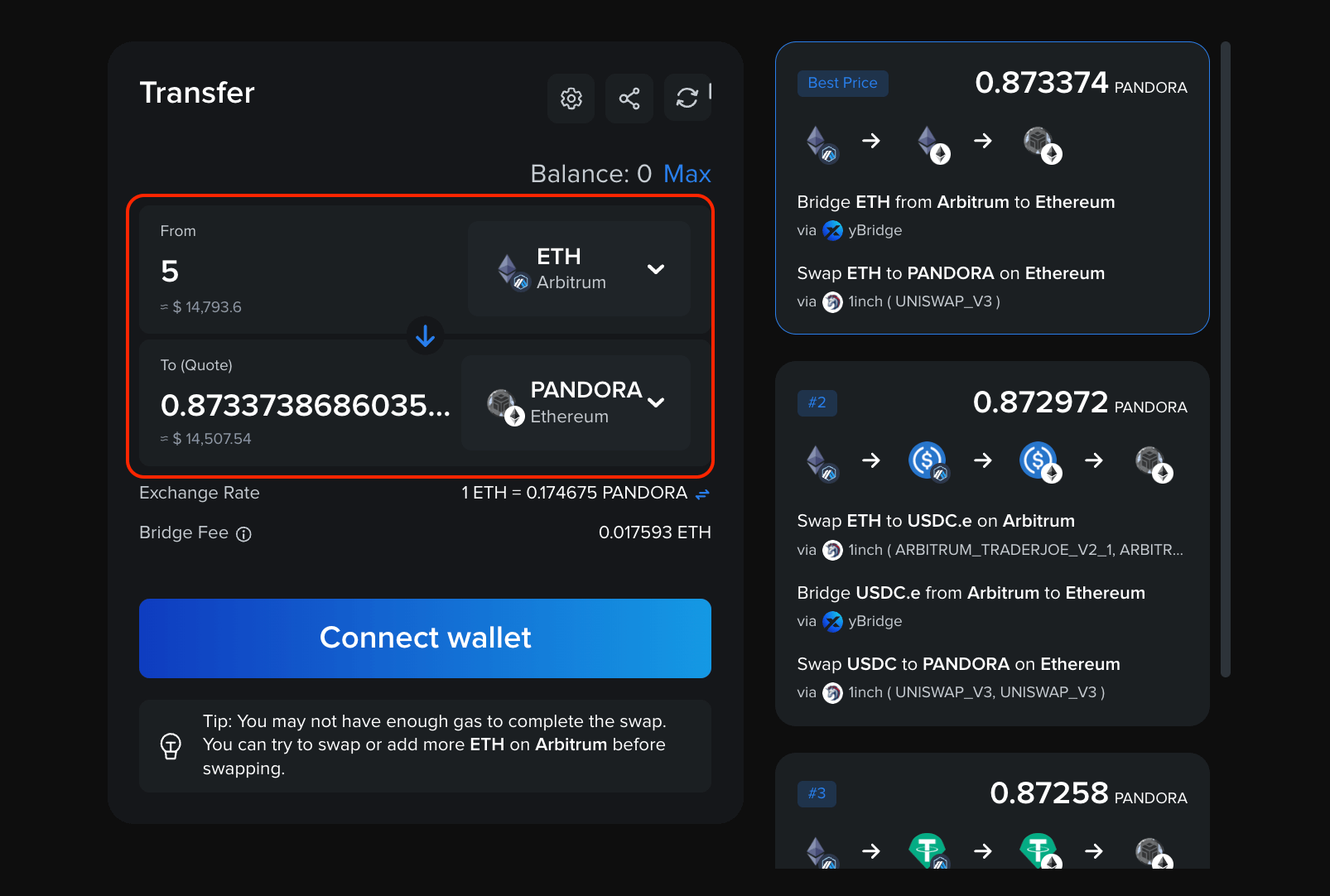

Pandora combines 10,000 ERC-20 tokens with 10,000 ERC-721 tokens. By purchasing 1 $PANDORA on Uniswap, users receive a generative avatar NFT named “Replicants” (not yet revealed).

According to the team, Pandora Replicants have five rarity levels. When users buy or sell Pandora, Replicants will be automatically burned and minted.

As the first ERC-404 token, Pandora has attracted a lot of attention from the crypto community. Its market capitalization has exceeded 160 million US dollars, and it has become the first token to be listed on a CEX. As of the time of writing, 1 $PANDORA is priced at an astonishing $16,886, and the floor price of the rarest Red Pandora Replicants is as high as 6.9 ETH (about $20,000).

Sheboshis

Sheboshis is an ERC-404 project launched by the Shiba Inu team. Holders of Shiboshis NFTs can claim a Sheboshis NFT for free (Shiboshis are male shiba inu, while Sheboshis are female shiba inu). There are 20,000 Sheboshis in total.

The ERC-20 token binded with Sheboshis has not yet been launched, but the NFT has already received some attention in the market. The trading volume exceeded 1,000 ETH in just one day after its release, and the floor price is currently around 0.1 ETH.

DeFrogs

DeFrogs is one of the earliest launched ERC-404 projects, but its token standard is different from that used by Pandora. The DeFrogs team claims to use an adjusted version of ERC404, and also states that DeFrogs is “The 1st ERC404 PFP.”

DeFrogs launched through a fair launch on Uniswap, allocating 80% of its total supply directly into the liquidity pool. The total supply of tokens is 10,000. DeFrogs’ art style can be seen from its name, which is a combination of the well-known NFT project “DeGods” and the meme “Pepe the Frog.”

As of this writing, the price of DeFrogs is around $820, down from its all-time high. The floor price on OpenSea is 0.35ETH.

As ERC-404 becomes more popular, dozens of ERC-404 projects have emerged. If you want to dig out more interesting projects, you can check them out on Coinranking!

Potential Issues with ERC-404

ERC-404 is an experimental token standard that has received a lot of attention from the market in less than a month since its launch. However, there are still many problems that need to be solved.

Informal Token Standard

ERC-404 is not an official Ethereum token standard. The Pandora team is still actively working on an Ethereum Improvement Proposal (EIP) and optimizing the code, which will take some time.

Randomness of NFT Burning

Take Pandora for example, since Pandora Replicants have five rarity levels, when you sell 1 $PANDORA on Uniswap, 1 Replicant will be burned randomly. You cannot specify which Replicant you want to sell in advance.

In addition, by repeatedly buying and selling ERC-404 tokens, you can constantly burn and mint NFTs. This will lead to the fact that if you are not satisfied with the rarity or pattern of the NFT, you can re-mint it through trading until you are satisfied. Although this is not entirely a disadvantage, it also goes against the randomness that some NFT projects pursue.

How to Trade ERC-404 Tokens?

Now that you have a comprehensive understanding of ERC-404, let’s take a look at the best places to trade ERC-404 tokens!

Uniswap

Since most ERC-404 tokens are launched via a fair launch on Uniswap, trading on Uniswap is the most common way to trade them. However, Uniswap only supports swaps on a single chain, so swapping assets from other chains directly is not allowed.

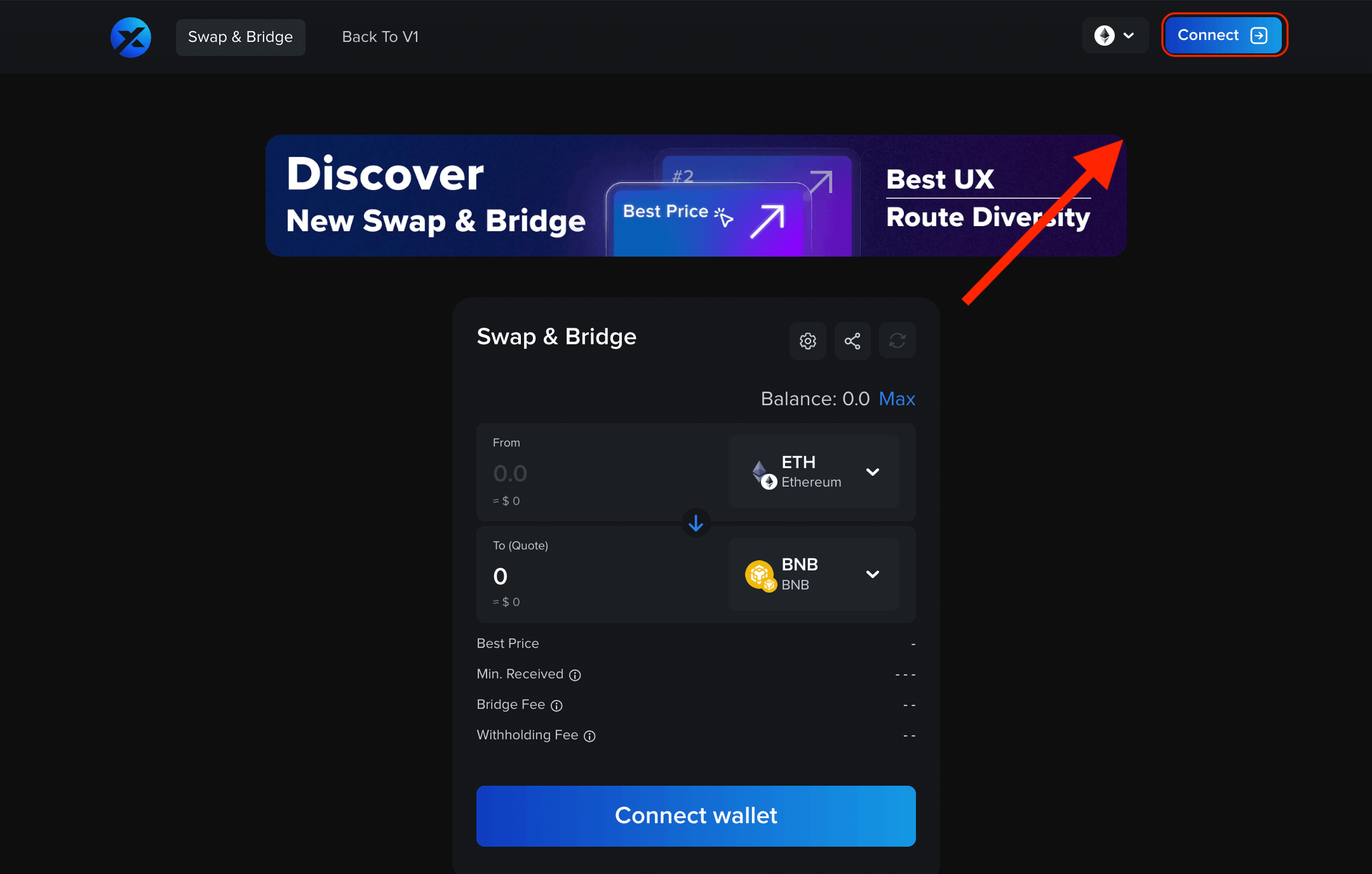

Cross-chain Bridges Aggregator: XY Finance

In light of this, using third-party cross-chain bridges to swap assets may be a better option. XY Finance enables users to do so in a quick and easy way!

XY Finance is a cross-chain bridge aggregator that operates on 20 EVM chains, including Ethereum, Arbitrum, Linea, and more. XY Finance’s user-centric approach enables easy token swaps between different chains providing users with the best option with great prices.

Don’t waste your time! You can now swap any ERC-404 tokens with the simple guide:

- Visit XY Finance and connect your wallet.

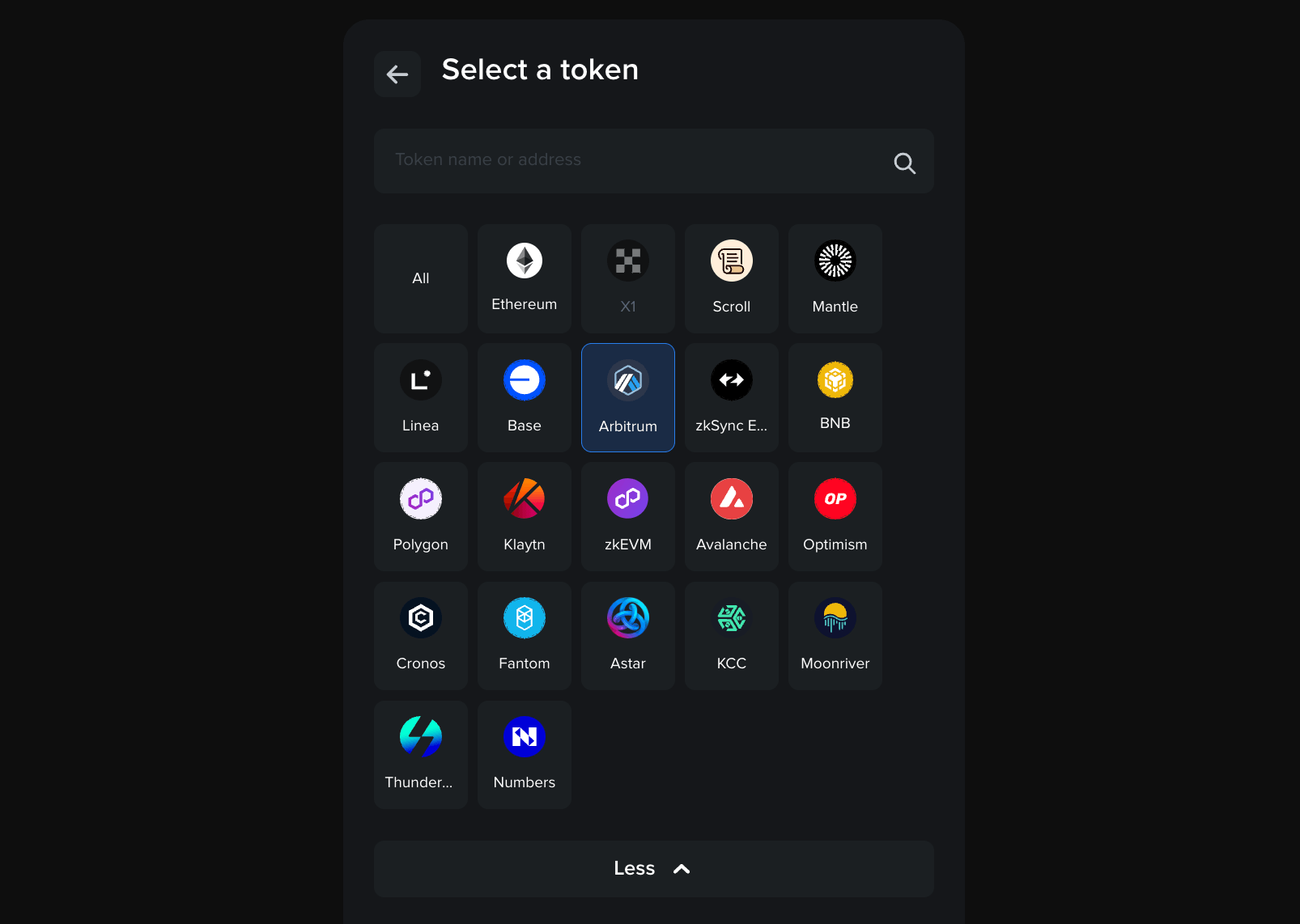

- Select source chain & token.

- Select the ERC-404 token you want and enter the amount. You can copy paste the token address in the search bar if the token you want didn’t show up.

- Review and confirm the transaction. Your tokens will arrive in under 5 minutes.

If you are looking for a safe, secure, and affordable way to trade ERC-404 tokens, XY Finance is the best option for you.

(Encountering any problems while bridging? Check out our comprehensive tutorial.)

Conclusion

ERC-404 is a new token standard that has the potential to revolutionize the NFT market. By understanding the basics of ERC-404 and how to trade ERC-404 tokens, you can be well-positioned to take advantage of this new technology!

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form