Looking for a handy guide to the BNB Chain? Look no further! Read on for a comprehensive article all about it!

What is BNB Chain?

BNB Chain, formerly known as Binance Chain, is an Ethereum Virtual Machine (EVM) compatible blockchain platform capable of smart contract execution. Launched in September 2020, it’s a Layer 1 (L1) that is part of the Binance ecosystem. BNB is known for its fast transaction time and low transaction cost, and works in parallel to Binance Chain — the exchange’s first blockchain that has a more simplified structure providing fast trading with high network loads.

BNB operates using the Proof-of-Stake Authority (PoSA) consensus algorithm. Its essence is the same as the more common Proof-of-Stake (PoS), wherein network participants use BNB token staking to participate in block generation. However, in PoSA, 21 validators process transactions selected daily from a pool of candidates, and there are certain staking and performance requirements for the validators. Furthermore, network participants can ‘delegate’ tokens to one of the validators and receive an appropriate reward percentage in return. For example, if a block is successfully added, participants receive a commission for transactions within the block. Generation time for one block is purportedly around 3 seconds. In total, BNB can process up to 160 TPS!

BNB Beacon Chain vs. BNB Smart Chain

Did you know? The BNB Chain actually has a dual architecture, meaning it runs two chains at the same time. These two are the BNB Beacon Chain and the BNB Smart Chain (BSC) and they are independent of each other. This means that in the event that one shuts down, the other will still remain fully operational.

The BNB Beacon Chain is mainly used for governance and allows the community to stake BNB, the chain’s governance token, as well as vote on decision-making. On the other hand, BSC is the one that hosts the blockchain ecosystem and thus allows the execution of smart contracts, dApps, and other Web3 applications.

BNB Chain’s Pros and Cons

Let’s take a deeper dive into some of the advantages and disadvantages of the BNBof BNB Chain.

Pros

- Cheaper Transactions: BNB is more affordable compared to Ethereum

- High Adoption Rates: This effect is brought about by centralization and the fact that Binance is able to ensure its stability and development

- Accessibility: Resources from Binance are widely available making it easier to work with the ecosystem’s tools and services

Cons

- Centralization: Because it’s supported largely by Binance, BNB is a centralized system

- Slow Development: Most innovations in the field are happening in Ethereum and not BNB; new features are implemented in the former first before coming to the latter

Comparative Analysis of L1 Blockchains: BNB Chain vs. Others

After understanding BNB Chain, let’s examine its strengths and weaknesses from a data perspective relative to other popular Layer 1 chains.

| Blockchain | Transaction Speed | TVL | Active Addresses |

| Ethereum | 15–20 TPS | $63.256 b | 365,162 |

| Tron | 2000 TPS | $9.117 b | 2.18 m |

| BNB | 10,000 TPS | $5.606 b | 1.02 m |

| Solana | 2000–3000 TPS | $4.95 b | 712,801 |

Strengths:

- Transaction Speed: BNB Chain boasts the highest transaction speed at 10,000 TPS, significantly outperforming Ethereum, Tron, and Solana. This makes it highly efficient for processing large volumes of transactions quickly.

- Active Addresses: With 1.02 million active addresses, BNB Chain has a robust and engaged user base, which is crucial for network activity and adoption.

Weaknesses:

- TVL (Total Value Locked): BNB Chain has a TVL of $5.606 billion, which is lower than Ethereum and Tron. This indicates it has less capital locked in its ecosystem compared to these competitors.

- Market Adoption: While it has a strong user base, BNB Chain’s TVL suggests that it might not be as widely adopted or trusted for large-scale financial activities compared to Ethereum and Tron.

In conclusion, BNB Chain stands out with its exceptional transaction speed and a large number of active addresses, indicating strong user engagement and high network efficiency. However, its lower Total Value Locked (TVL) compared to Ethereum and Tron suggests it may not yet be as widely adopted for significant financial activities. This indicates potential for growth in attracting more capital and expanding its market adoption. Overall, BNB Chain’s strengths in speed and user base position it well for future growth in the competitive Layer 1 landscape.

Ecosystem on BNB Chain

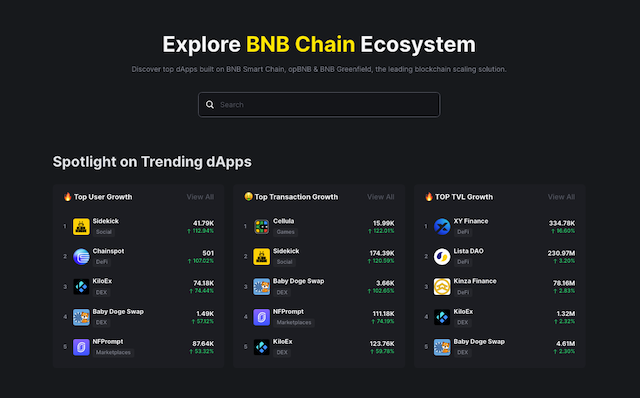

No matter what piques your interest—be it DeFi, NFTs, GameFi, or more—there’s surely a dApp in the BNB ecosystem that will suit your fancy.

Here are a few highlights from the BNB chain ecosystem.

DEX – PancakeSwap

PancakeSwap is an “all-in-one multichain DEX” where users can trade, earn, game, and own NFTs.

Lending – Venus

Venus is lending platform on the BNB Chain. It allows users to lend and borrow tokens and earn interest on their deposits. Venus also enables the minting of synthetic stablecoins, such as VAI, which are backed by a basket of cryptocurrencies.

Derivatives – Aevo

Aevo is a decentralized trading platform with CEX-like performance. It supports options, perpetual futures, and many other products within a single margin account.

Restaking – BounceBit

BounceBit is the “first-ever native BTC Restaking chain.” Its network is secured by staking both Bitcoin and BounceBit tokens, with a Proof-of-Stake (PoS) mechanism that introduces a unique dual-token staking system by leveraging native BTC security with full EVM compatibility.

Tool – SpaceID

SpaceID is a permissionless name service protocol for Web3 communities, billing itself as a one-stop Web3 domain and identity platform.

Privacy – Tornado Cash

Tornado Cash is a non-custodial privacy solution. It uses smart contracts to allow users to send transactions anonymously by obfuscating the on-chain link between the source and destination addresses. Users deposit token into the Tornado Cash smart contract, which then mixes it with other deposits, making it difficult to trace the original source of the funds when they are withdrawn.

To discover more about the rapidly growing ecosystem, make your way to the BNB Chain ecosystem page and start exploring today!

How to Bridge to BNB Chain?

You might think that BNB chain bridges are the simplest or easiest way to transfer assets to and from BNB. However, these services do have a few drawbacks. Given its limitations, why not explore the potential of using XY Finance? It’s an efficient and user-friendly way to move your assets to and from BNB and 20+ other chains!

XY Finance is a cross-chain bridge aggregator that operates on 20 EVM chains, including BNB, Ethereum, Linea, zkSync, and more. XY Finance boasts a user-focused approach that makes transferring tokens between different chains a lot easier and much more efficient. This provides users with the best options at the most affordable prices too.

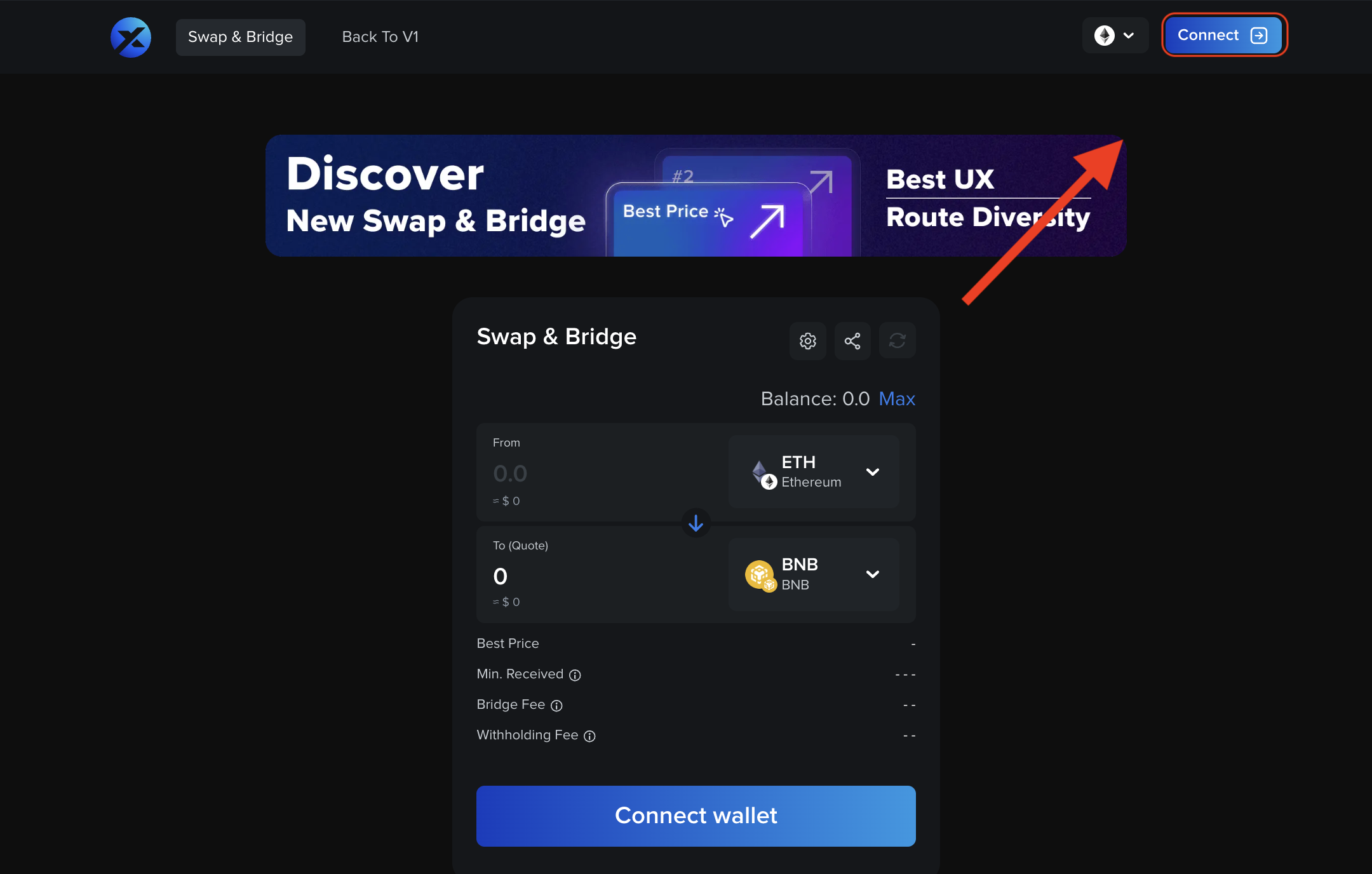

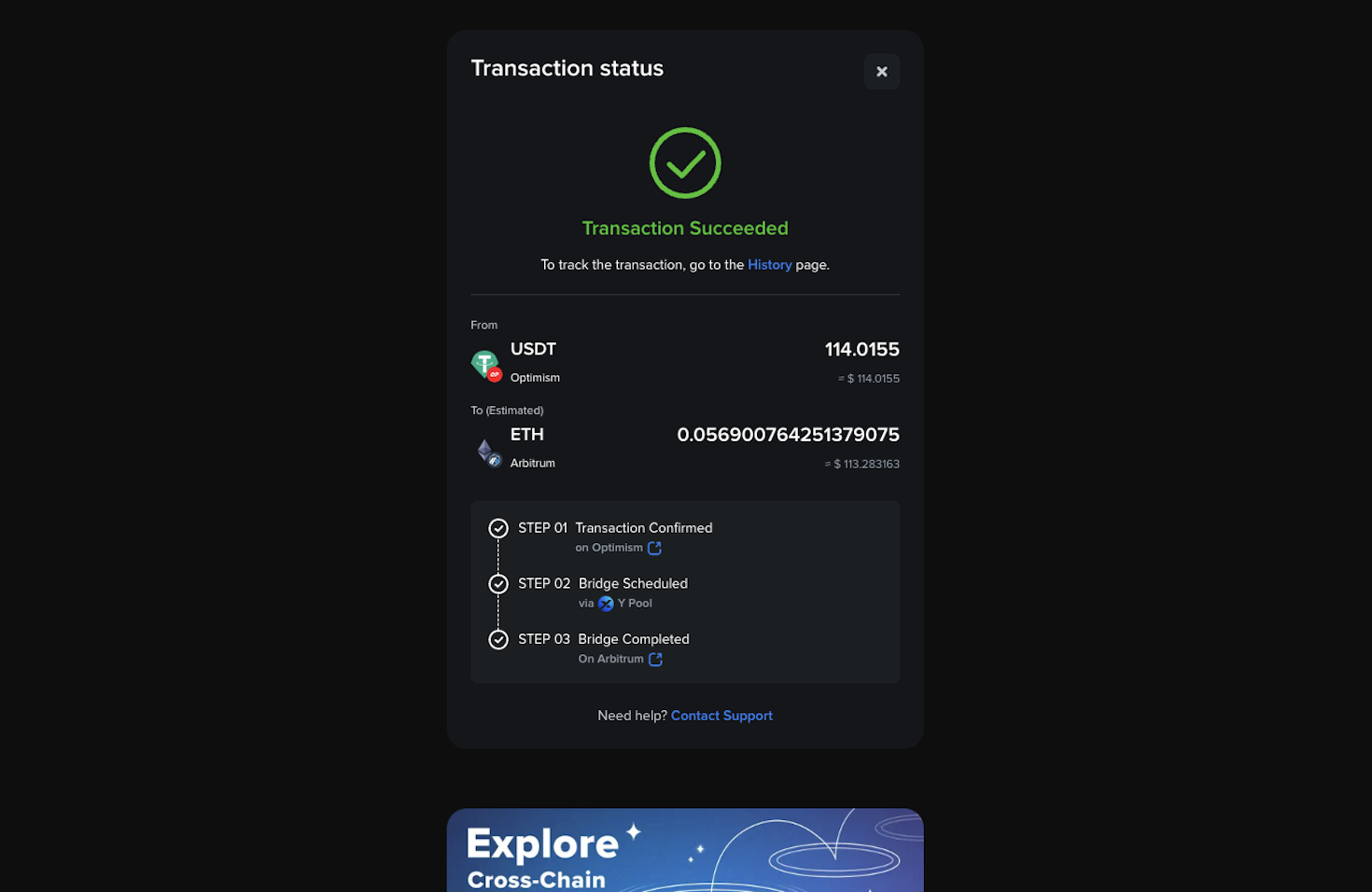

Don’t waste your time! You can now bridge tokens to BNB Chain with this simple guide:

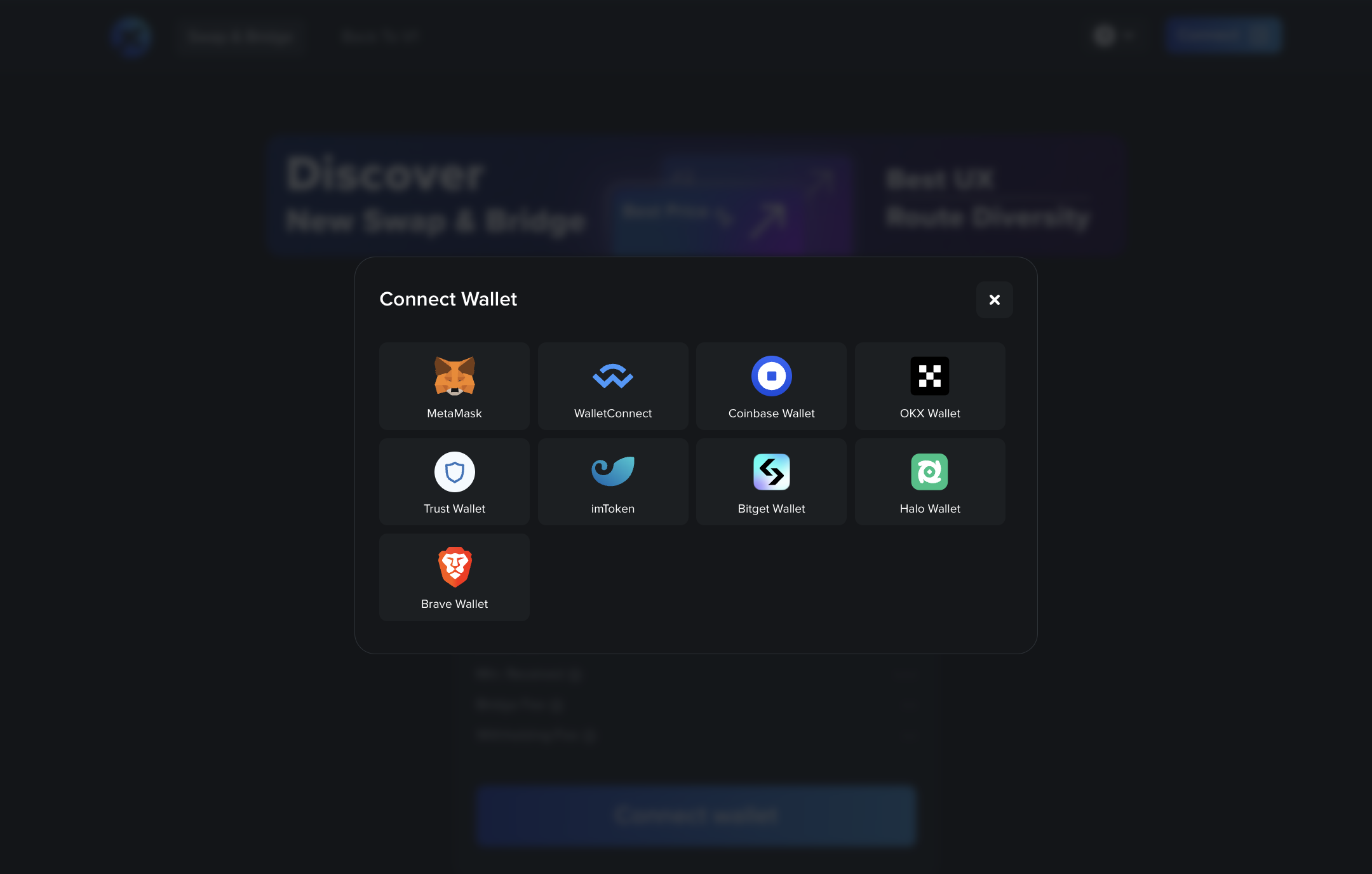

- Visit XY Finance and connect your Wallet.

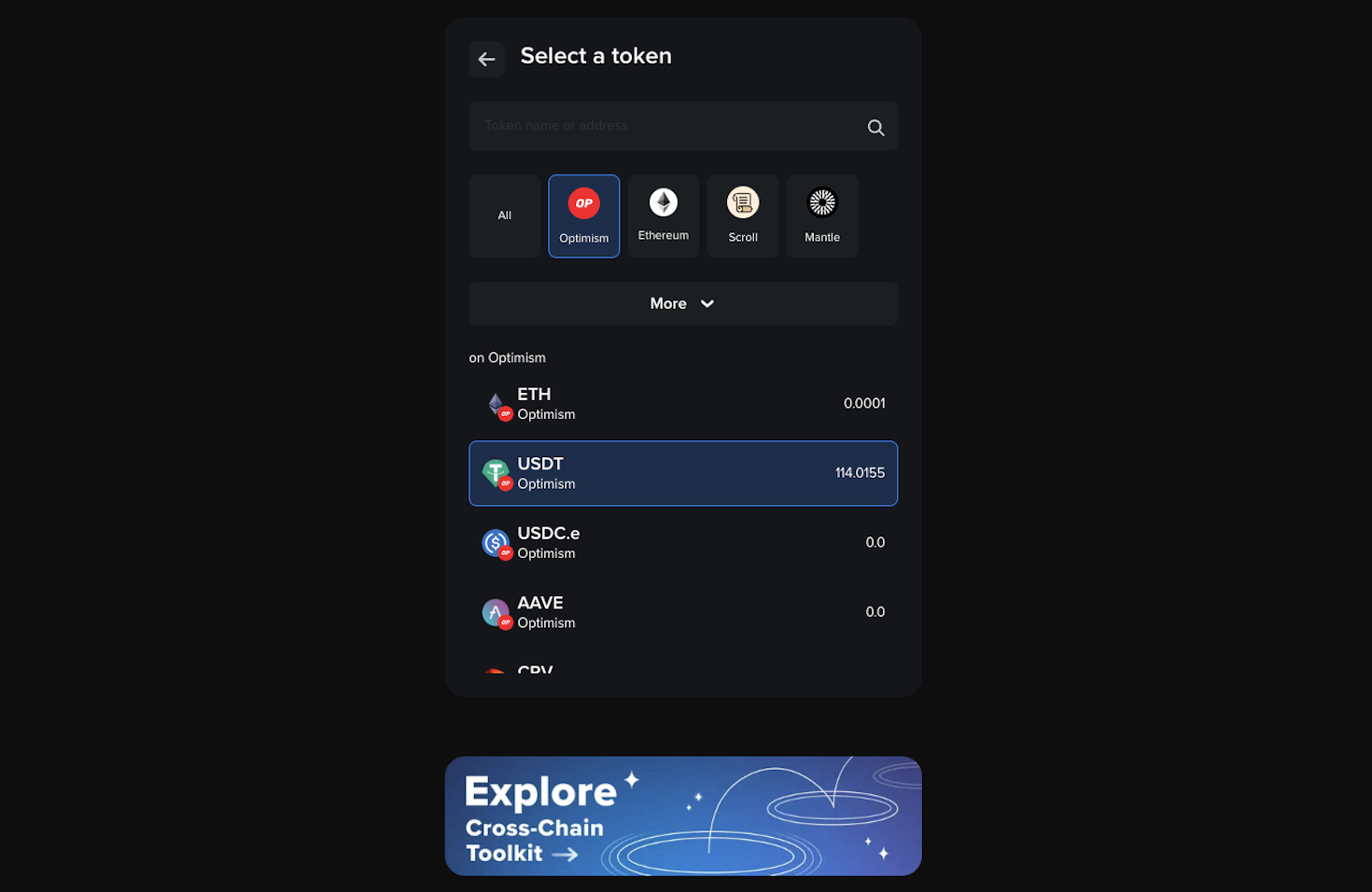

- Select the network you want to transfer tokens from (Ethereum, Polygon, Arbitrum, Avalanche, Optimism + 15 others).

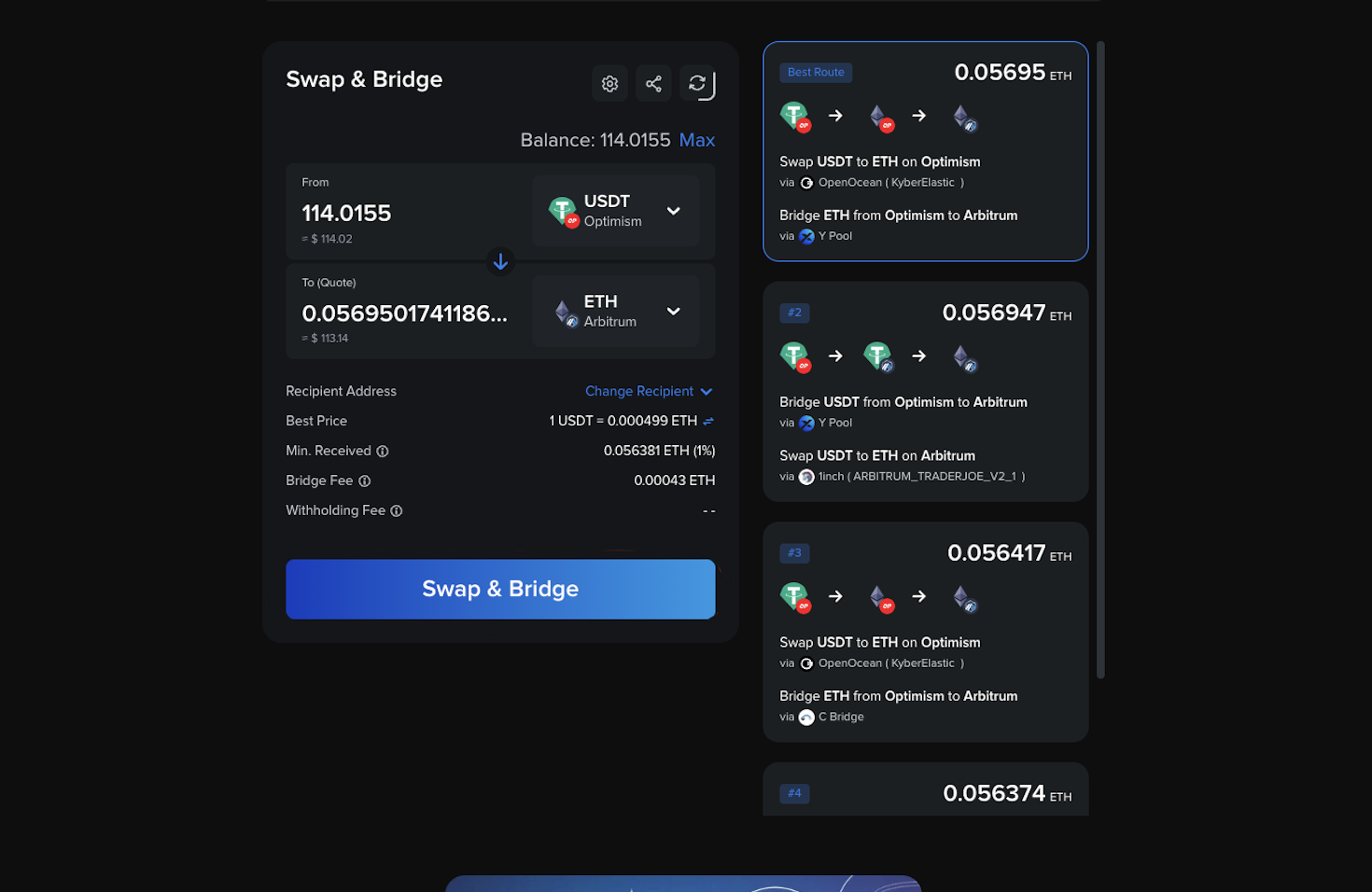

- Select the token you want to bridge from your network to Optimism and input the amount.

- Review and confirm the transaction. Your tokens will arrive in under 5 minutes.

(Encountering any problems while bridging? Check out our comprehensive tutorial.)

You’re all prepared! Hit the button and begin your exploration of the BNB Chain universe!

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form