What is Polygon?

Polygon blockchain (MATIC) is a parallel Layer 2 (L2) sidechain that enables faster transaction speeds and lower fees for transactions to and from the Ethereum mainnet. It is a stack of protocols dedicated to fixing Ethereum’s scalability issues, allowing users to trade digital assets such as cryptos, Dapps, and NFTs freely between chains and giving them full freedom of their asset movement. In a nutshell, it is a platform meant to mitigate the heavy traffic on Ethereum, which is home to a vast range of economic activities, and to help build an Ethereum-compatible ecosystem and connect various chains into one interconnected whole.

Bridges on Polygon

Before delving into the bridges on the chain, we must first be equipped with the understanding that a bridge is basically a set of smart contracts that assist in moving assets from the mother chain to the child chain. Ethereum and Polygon are the blockchain duo in this case.

We now all know that Polygon not only lends Ethereum a helping hand by delivering cheaper and speedier transactions but also strengthens the Ethereum ecosystem through efficient tools that help build scalable DApps. Next, it’s important to know what bridges there are at your disposal. There are 2 primary bridges that move assets between Ethereum mainnet and Polygon. The first one is the PoS (Proof-of-Stake) Bridge. The second one is Plasma Bridge, which, on the other hand, offers increased security guarantees.

PoS Bridge

As the official MATIC Bridge, PoS Bridge is more flexible and features faster withdrawals, taking up less time to process bridging requirements. This bridge native to Polygon is most often used for transferring assets from Polygon to the Ethereum mainnet due to its speed. It is the most popular and straightforward for transferring ETH and most ERC tokens, making use of the PoS consensus algorithm to secure its network. Crypto holders who need some flexibility and faster withdrawals will be cool with the relatively less strict level of safety standards of the PoS Bridge.

To sum up, deposits on the PoS Bridge are instantly confirmed and secured, and withdrawals are more efficient via PoS Bridge. That being said, they may still take a while to verify. A withdrawal via PoS Bridge usually takes between 45 minutes and 3 hours, while Plasma bridge will require as long as 7 days.

Plasma Bridge

As noted earlier, Plasma Bridge taps into more stringent measures at the cost of taking more time (usually 7 days) to withdraw assets back to the Ethereum mainnet. In this regard, quite a few traders choose the Plasma Bridge to get their assets across to the Polygon and then the PoS Bridge for the opposite scenario. To recap, there is a 7-day withdrawal term associated with all exits and withdraws from the Polygon chain to Ethereum on the Plasma Bridge.

Whether it’s the PoS or the Plasma Bridge, they both serve as trustless cross-chain trading channels between Polygon and Ethereum. Users are able to port tokens, Dapps, NFTs, and so on to the sidechain by using smart contracts. These two bridges are arguably the most pivotal technological part of the whole ecosystem. To wrap up, the Plasma Bridge is more suitable for developers that require higher security. It applies the Ethereum Plasma scaling solution and helps transfer MATIC, ETH, ERC-20, and ERC-721 tokens.

What is MATIC?

As one of the world-famous blockchains in the DeFi space, Polygon has, quite unsurprisingly, its own native cryptocurrency, and it’s called MATIC. From a broad perspective, this token is used for fee payment on the Polygon network, staking, and DAO governance (i.e. voting power), whereby MATIC holders can use the voting power to vote on changes to the Polygon framework. MATIC can be traded via exchanges such as Coinbase, Kraken, Huobi, and whatnot.

How to swap between Polygon and other chains

To take a dive into how to swap using Polygon, first it’s better to suss how it works. Remember we mentioned earlier that this sidechain is an L2 scaling solution that runs alongside the Ethereum mainnet? With this in mind, we can draw an analogy between blockchain and transportation.

One may as well picture Ethereum as the local bus, which stops nearly every station from a source chain to a destination chain, hence slower trading speed. Polygon, however, can be thought of as an express bus that makes fewer stops and is capable of moving assets much faster. Polygon employs a variety of technologies to create this efficient parallel chain and links it to the Ethereum mainnet. Below we will showcase how to make a swap using three cases.

BNB to Polygon & vice versa

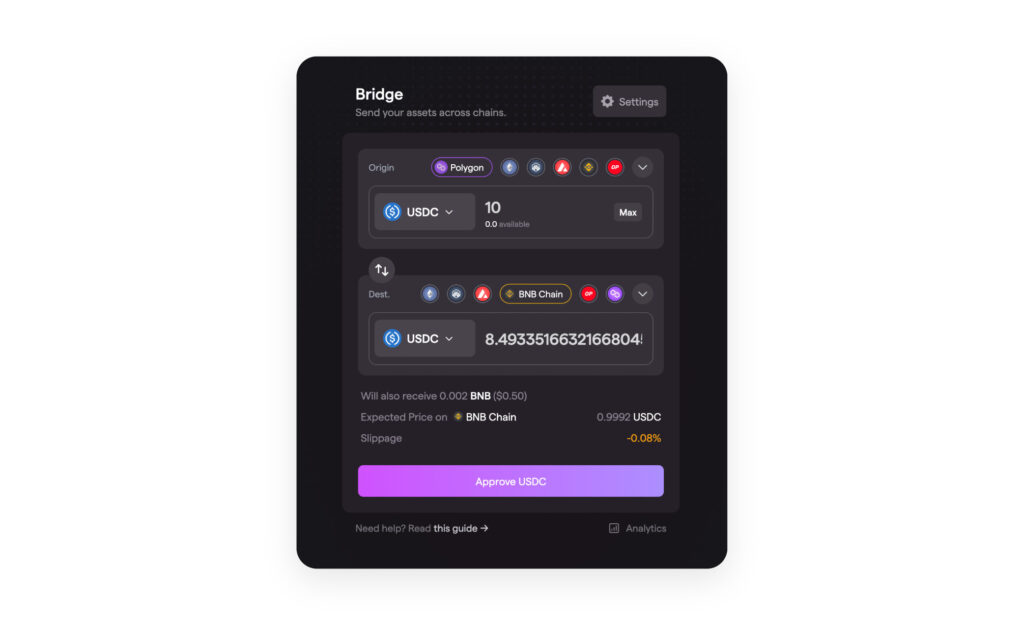

The best way to swap tokens from Binance Smart Chain (now BNB) to Polygon chain is by using third-party bridging protocols such as Synapse and AnySwap (now Multichain). Both of them provide cross-chain service and support BNB and Polygon. Here we will use Synapse as the bridge to swap USD Coin (USDC) between the two chains.

- Go to Synapse and connect your MetaMask wallet

- Select Polygon or BNB as your current (source) chain, and the other as the destination chain

- Input the amount of USDC you’d like to transfer

- Confirm the transfer and wait for the tx to go through (3-5 mins)

- The amount of USDC transferred will go into your destination MetaMask wallet

In terms of the bridging service fees, both BNB and Polygon have fairly low on-chain transfer fees, which makes the cross-chain deal between the chains quite cheap. Generally speaking, it would cost a user about $5-10 in fees to move assets from BNB to Polygon and the other way around through Synapse.

ETH to Polygon & vice versa

To participate in the network, you’ll need MATIC, which isn’t always easy to obtain from other networks’ DEXs. Bridge on Polygon thus allows users to move tokens from Ethereum ERC20 to Polygon Matic, which is the cheapest way to bridge ETH to Polygon. The bridges help transfer ERC tokens and NFTs to the sidechain through smart contracts, making it a lot easier to move assets back and forth. Here we use PoS (Matic) to swap whatever tokens between the two chains.

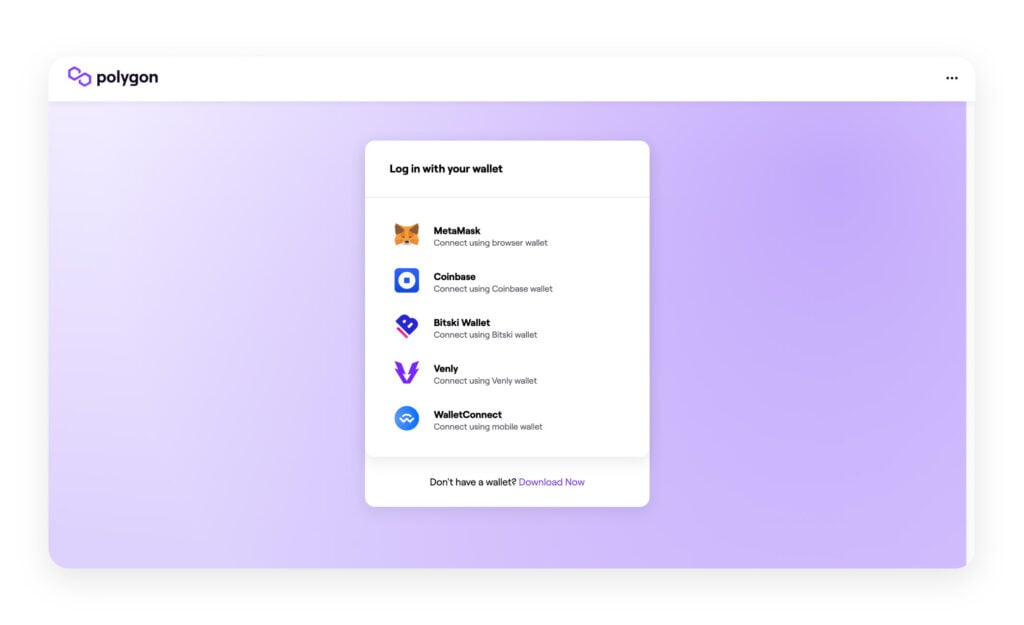

- Click on “Polygon Bridge” and login to its Web Wallet

- Connect your Ethereum Wallet to MetaMask, Coinbase Wallet, or whatever options there are on the list

- Connect your MetaMask wallet to your Polygon wallet. Note that a digital signature is required. Make sure all the info is correct before clicking on “Sign” to proceed.

- Go to the deposit tab and click the token you’d like to transfer. Enter the amount and click on transfer. Read the notes on the following page and click continue. Approve the estimated gas fees and click continue

- View your tx details (i.e. token amount and estimated transaction fee), and then click continue to sign and approve the transfer

- Check out your tx status on Etherscan

AVAX to Polygon & vice versa

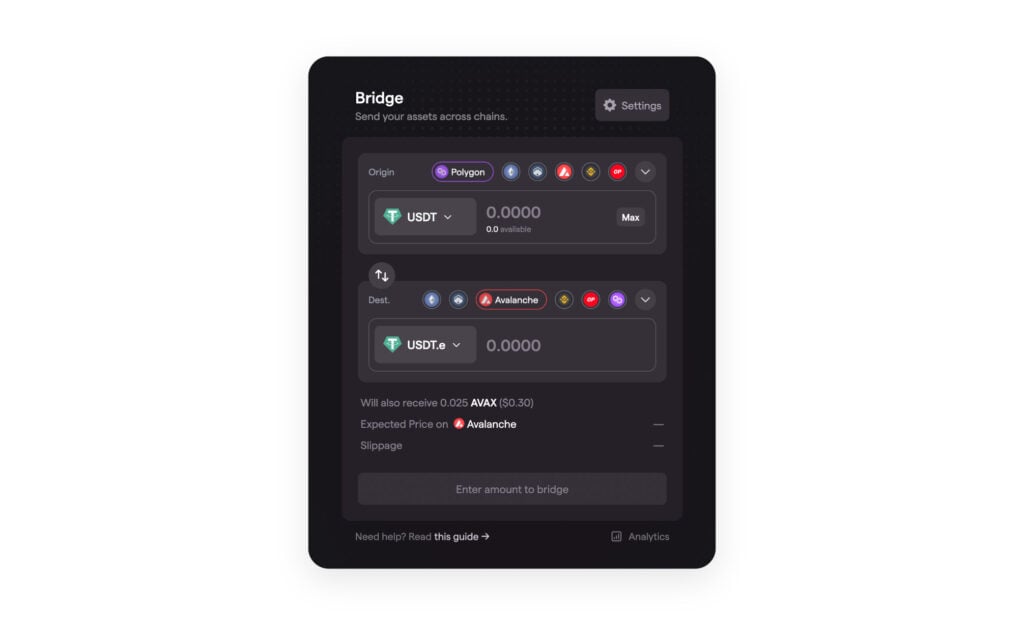

Still, the best way to port your assets from the MATIC ecosystem to the Avalanche ecosystem is through a cross-chain protocol (DEX), and one like Synapse allows its users to transfer stablecoins like USDC, USDT, or DAI from Polygon to the Avalanche C-Chain with low fees and little slippage. Platforms like Synapse do let users move stablecoins from EVM-compatible networks seamlessly, like from Polygon to Avalanche, Ethereum, Fantom, and so forth. Here we use Synapse again to bridge USDT between the two chains.

- Go to the official web page of Synapse and connect your MetaMask wallet as per instructions

- Select MATIC as your source chain, and Avalanche (AVAX) as the destination chain

- Key in the amount of whatever token it is that you wish to swap to USDT

- Click approve to complete the transfer

Broadly, users are expected to pay up to $0.5 USD in total to bridge their assets from Polygon to Avalanche. But the bridging service from AVAX back to Polygon may be a bit more expensive because the tx fees on the C-Chain are slightly higher, where users may pay up to $3 USD.

Tokenomics

According to CoinGecko, the total market value of a MATIC’s circulating supply multiplied by the current price as of press time is roughly $8.1B. In the table below we have garnered data about the tokenomics of the chain’s ecosystem.

| Market Cap | $7,099,531,458 |

| Circulating Supply | 8,955,469,069 |

| 24hr Trading Volume | $274,144,673 |

| Fully Diluted Valuation | $7,927,593,076 |

| Total Value Locked (TVL) | $6,259,689,390 |

| TVL Ratio | 1.27 |

As for the project details, or the exact allocation for MATIC, please view the table below. Note that the data are only accurate as of the time of writing.

| Binance Launchpad. | 19.0% |

| Foundation | 21.9% |

| Ecosystem | 23.3% |

| Staking Rewards | 12.0% |

| Team | 16.0% |

| Private Investors | 3.8% |

| Advisors | 4.0% |

Closing thoughts

We introduced the Binance ecosystem and BNB chain earlier in the hope of preparing crypto noobs with clearer appreciation of what centralized/decentralized exchanges and cross-chain bridges are. This time, we push ahead with another important bridging protocol–Polygon, which helps scale up the Ethereum-compatible ecosystem. The 2 types of bridge mentioned, Plasma and PoS, are the most essential element for the sidechain, and their purposes are different based on the users’ needs. In the main, this sidechain does shed some light on the dilemma of high fees and slow transaction speeds on Ethereum, giving traders a wider range of bridging choices.

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form