Love DeFi, but hate the slow and costly cross-chain transactions caused by unstable liquidity and unreasonable fees? Us too. That’s why XY Finance has been working tirelessly on the development of our unique cross-chain bridge: yBridge.

Liquidity is the fundamental core of XY Finance’s instant cross-chain transfer service. To better enhance the experience for our users, XY Finance has launched our third liquidity pool – ETH Pool. Users can now provide liquidity from supported tokens including USDT, USDC & ETH to our yBridge.

yBridge is ready to permanently end low liquidity and unreasonable fees, making good on our ultimate mission to provide reliable cross-chain liquidity to our XY Finance community.

Why is yBridge Important

To deliver the best cross-chain experience, XY Finance introduced Swap & yBridge. While Swap provides a convenient interface for users to instantly transfer a wide range of tokens to different blockchains and L2 roll-ups, yBridge maintains an efficient cross-chain liquidity pool by incentivizing liquidity providers. By leveraging the power of having XY Finance’s own liquidity pool, XY Finance can ensure the best trade route in terms of speed & security for users via our own liquidity pool!

With the help of yBridge, XY Finance features the following five outstanding advantages:

- Instant cross-chain transfers (only two transaction IDs needed)

- Incentivized rebalance system (prevents liquidity pool from drying up)

- Earn your share of all transaction fees based on your provided USDC/USDT/ETH liquidity

- No impermanent loss thanks to our single-asset liquidity pools

- Highest composability thanks to many tokens being swappable on XY Finance

What Can I Get From Being A Liquidity Provider?

In this new multi-chain universe, yBridge allows users to move their assets across all supported chains instantly and seamlessly by providing trusted cross-chain liquidity. To reward community members for providing the ETH stable asset to yBridge, we will be handing out xyETH, our pool-side token representing your share of pool rewards.

We appreciate all our community members that contribute to yBridge in order to create a better user experience, so we’ve chosen to put 60% of the swap fee towards yBridge rewards, the rest will land in the DAO treasury.

In the event that an extremely large amount of assets are swapped across chains, it’s possible a chain’s pool can dry up from a lack of assets in that chain’s yBridge, as each chain has its own pool. To prevent this, rewards are based on your percentage of the total pool, meaning contributing to a smaller pool yields you a larger piece of that juicy swap fee reward.

Currently you can provide ETH liquidity on the following chains:

- Ethereum

- Blast

- zkSync Era

- Linea

- Polygon

- Polygon zkEVM

- BNB

- Cronos

- Cronos zkEVM

- Fantom

- Arbitrum

- Optimism

- Avalanche

- Taiko

- X Layer

- Mantle

Key Points to Know Before Joining yBridge Yield Farming

Due to yBridge being built on the OmniChain, there are several key features you should be aware of when engaging in yBridge Yield Farming:

yBridge LPs Earn Bridge Fee automatically

The gains are distributed to be included in the deposit certificate, which is like an interest-bearing token but earning from bridge fees, not from interests. More TVL can generate more bridge fees and keep the APY maintaining.

Before depositing into yBridge, you must know the “Withholding Fee”

Why will XY have a withholding Fee? Because XY Finance is using its own OmniChain Solution to run the bridge pools on our supported chains (more are coming on zkrollups). Therefore, the deposit and withdrawal of yBridge will have been completed in two transactions. To cover the gas fee used for the second transaction, XY Finance will charge a withholding fee.

Why does XY Finance uses “OmniChain” to build bridge liquidity pools?

By doing so, all assets deposited in yBridge will be calculated together. That’s to say, 1 xyETH on Arbitrum is equal to 1 xyETH on Poylgon zkEVM. Both are equal to 1.034675 ETH (current price.)

How long does Deposit and Withdraw in/from yBridge take?

On average, it takes around 1 mins to complete the deposit and withdrawal. When you deposit assets into yBridge, the system will send your deposit certificates such as xyUSDC, xyUSDT, and xyETH in the second transaction.

How to withdraw your assets in yBridge?

It’s simple as long as you click the withdrawal and the system will process it. If the liquidity isn’t enough, please wait for a while, and the team will inject more liquidity into it.

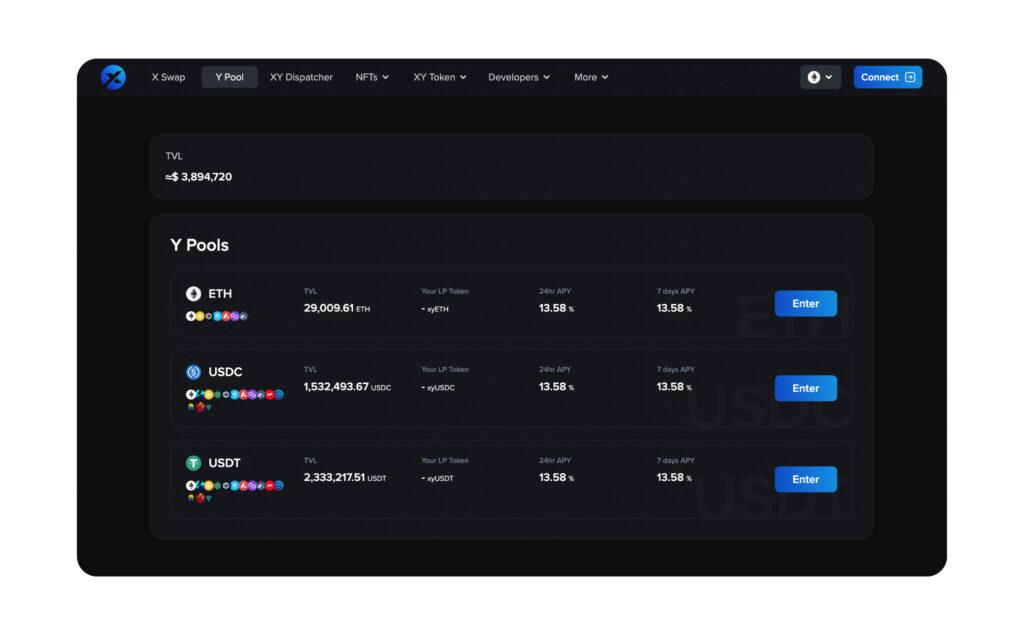

How to Deposit (Provide Liquidity) on XY Finance yBridge

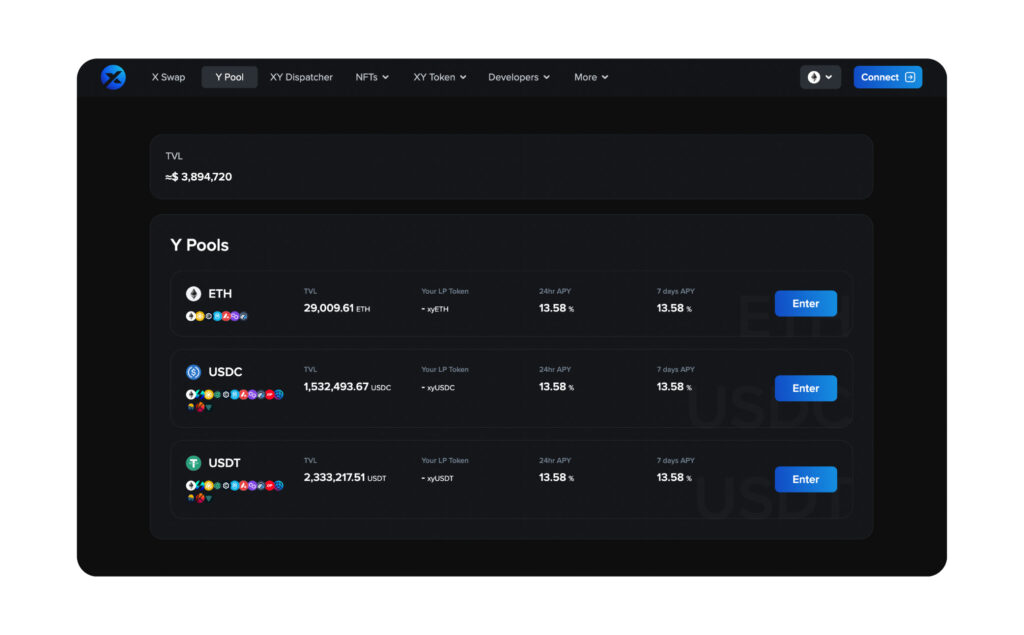

⓵ Visit XY Finance yBridge page

To provide liquidity, you’ll need to commit an amount of USDT, USDC or ETH

Here, we’re going to use ERC-20 ETH as example

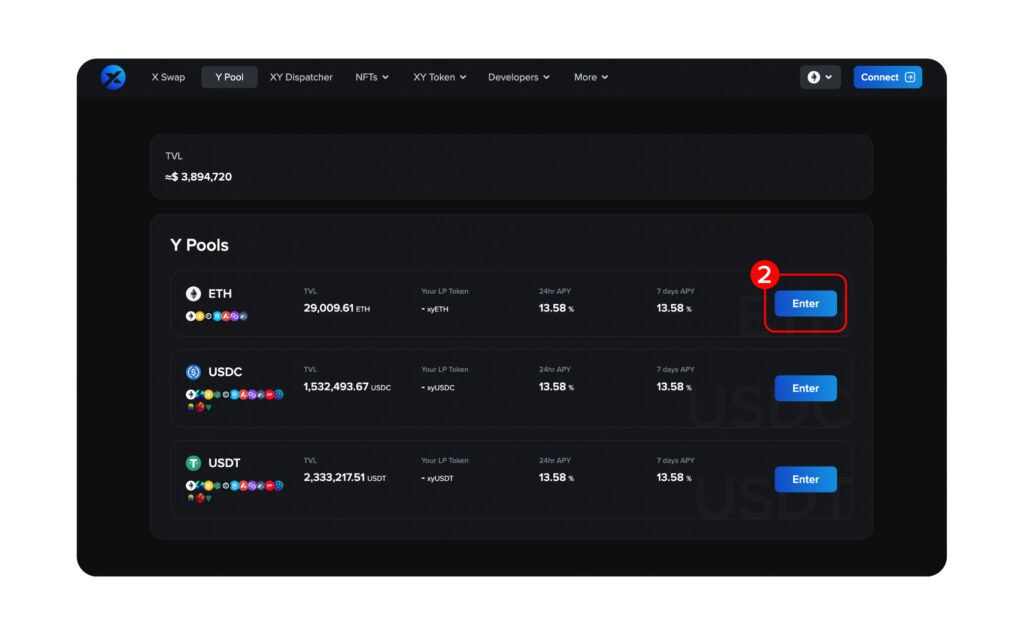

⓶ Click the “Deposit” button

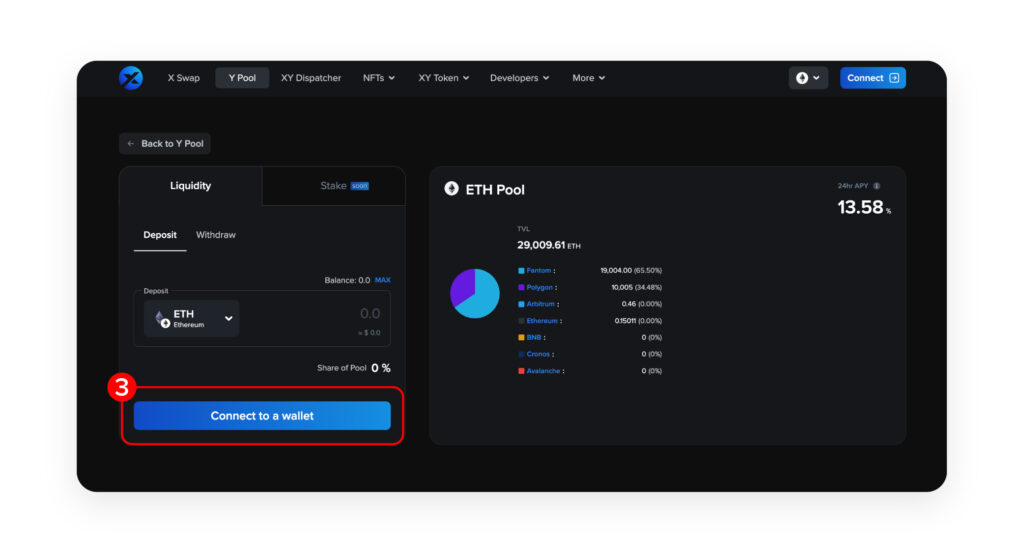

⓷ Connect to a Wallet

If your wallet is already connected, you can ignore this step

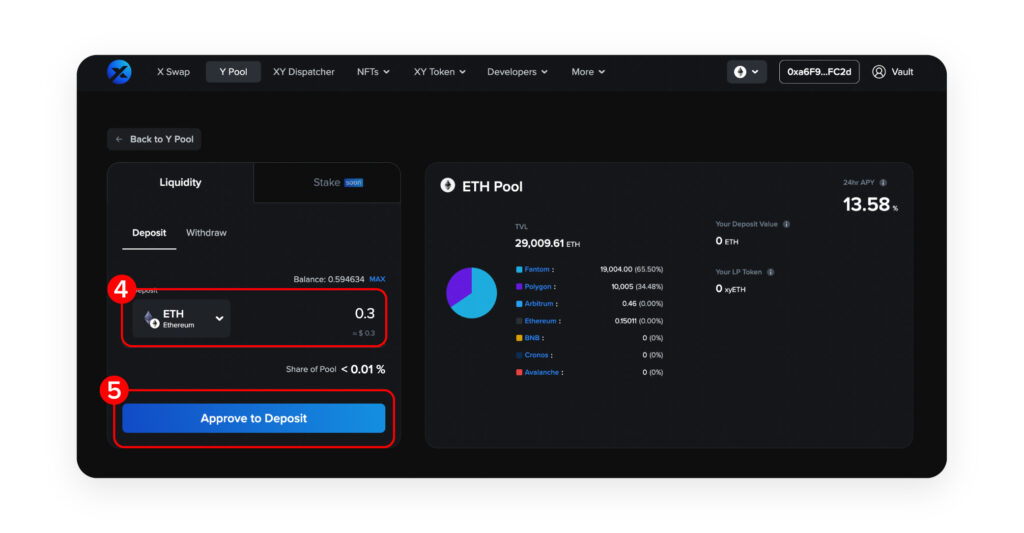

⓸ Choose ETH from which network you want to add liquidity to

Enter the amount of ETH you wish to deposit

⓹ Click the “Approve to Deposit” button

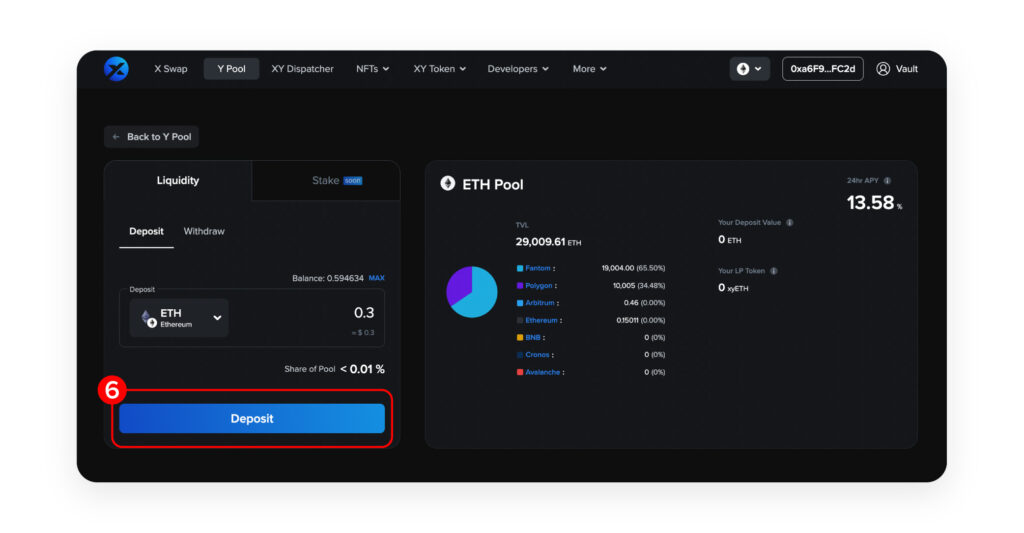

⓺ Click the “ Deposit” button, and your wallet will ask you to confirm the action

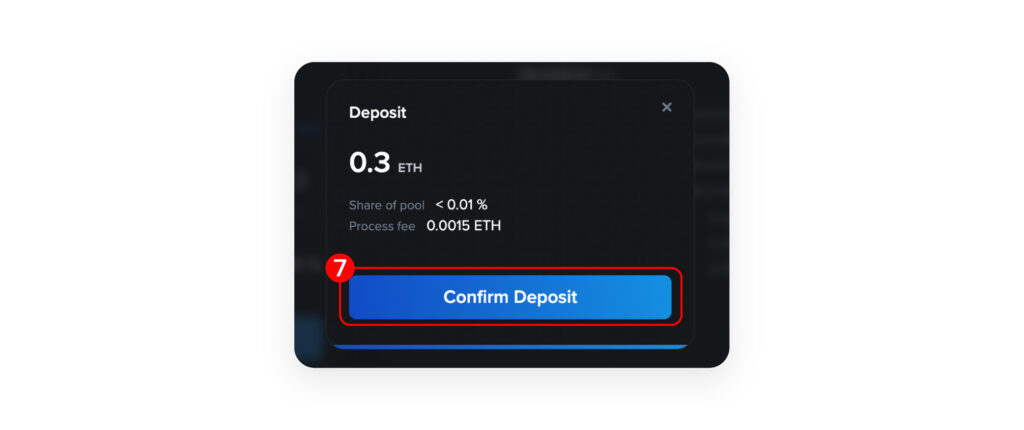

⓻ After double-checking the details, click “Confirm” button to proceed

Your wallet will ask for your confirmation again. Confirm your transaction from your wallet

⓼ There’s no step 8! You can check all your deposit record in XY Vault.

How to Withdraw (Remove Liquidity) on XY Finance yBridge

⓵ Visit XY Finance yBridge page.

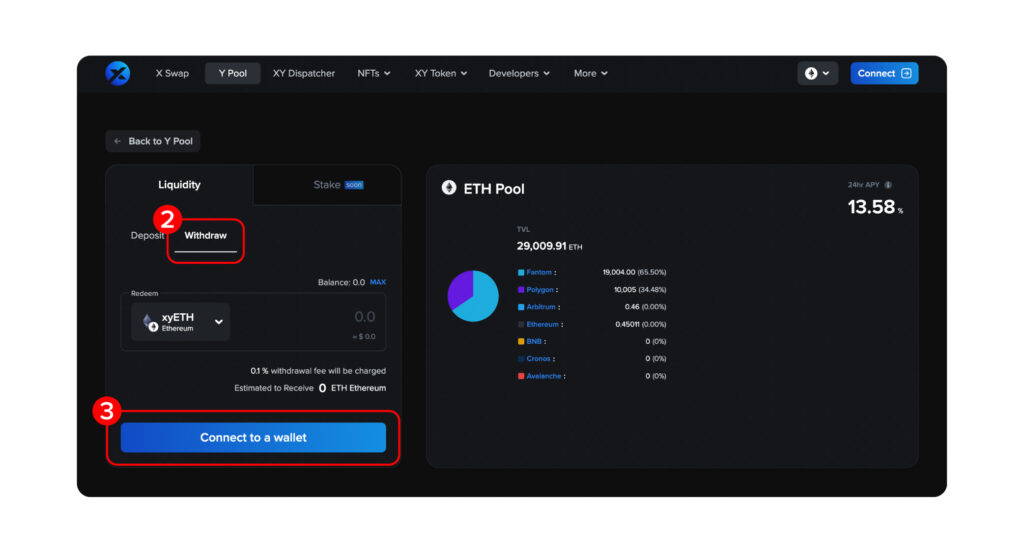

⓶ Click the “Withdraw” button.

⓷ Connect to a Wallet

If your wallet is already connected, you can ignore this step!

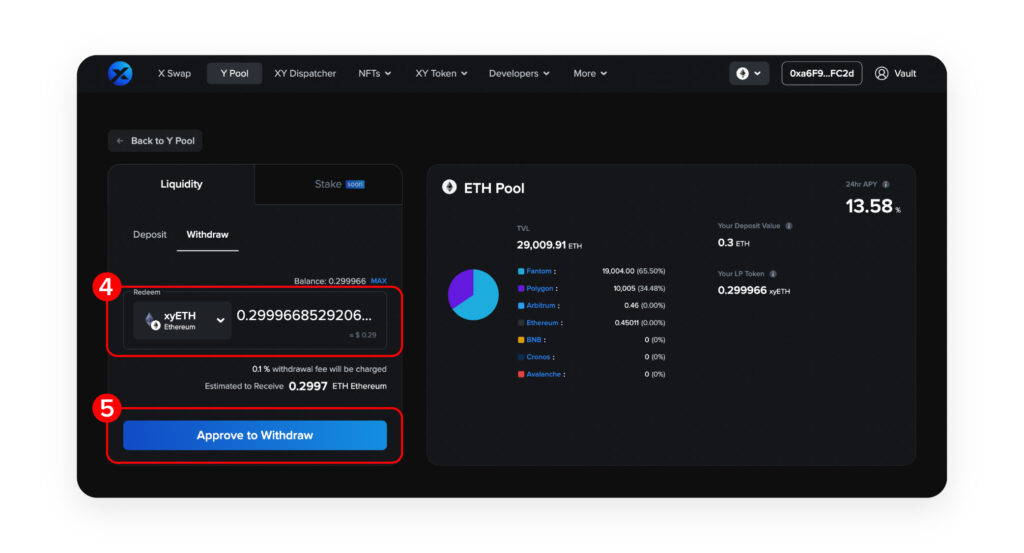

⓸ Enter an amount of xyETH you wish to withdraw

⓹ Approve to Withdraw

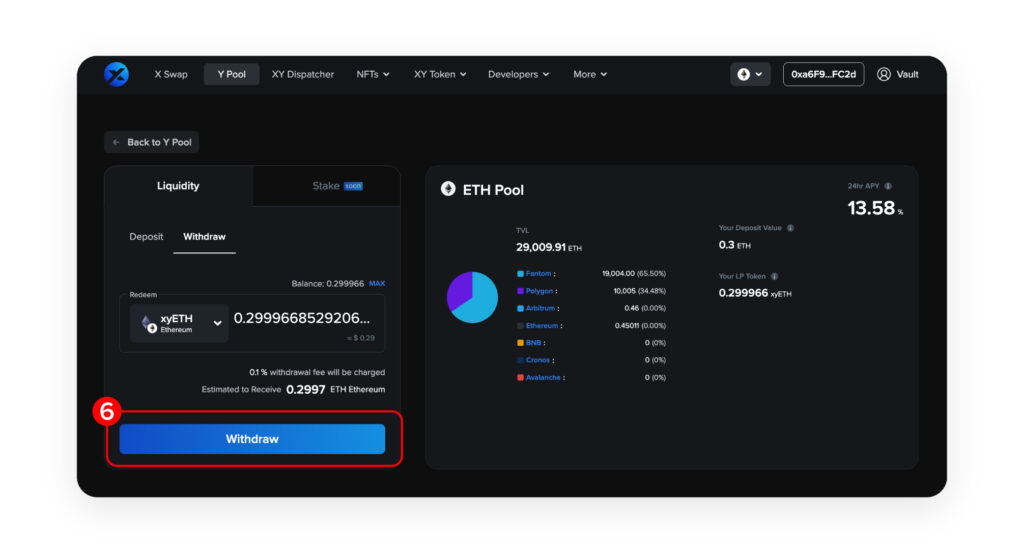

⓺ Click the “Withdraw” button, and your wallet will ask you to confirm the action

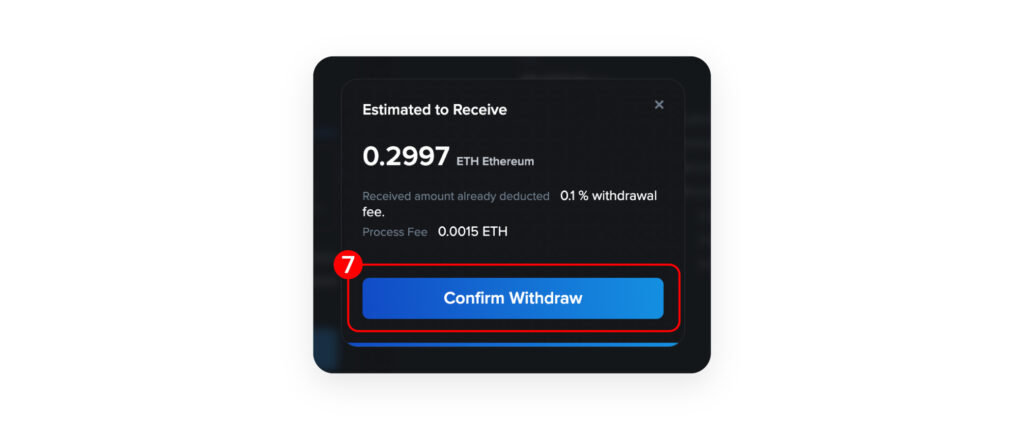

⓻ After double-checking the details, click “Confirm Withdraw” button to proceed

Your wallet will ask for your confirmation again. Confirm your transaction from your wallet

⓼ There’s no step 8! You can check all your withdraw record in XY Vault

Easy-peasy aight! If you encounter any issues while depositing or withdrawing, you can open a ticket or reach out to us on Discord. Our official Alpha members will give you all the support you need!

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form