In this article, we will delve into the Arbitrum Ecosystem, highlighting intriguing and essential Dapps available on it!

What is Arbitrum?

Arbitrum is a Layer 2 (L2) scaling solution for Ethereum that aims to improve its scalability and reduce transaction costs. It uses Optimistic Rollup technology to bundle transactions together and process them off-chain, before submitting them to the Ethereum mainnet for final settlement. This reduces congestion and lowers fees.

Arbitrum has several advantages over the Ethereum mainnet:

- Faster transactions: Transactions on Arbitrum are significantly faster than on the Ethereum mainnet, sometimes by a hundred times or more.

- Lower costs: Transaction fees on Arbitrum are much cheaper compared to the mainnet.

- Compatibility: Arbitrum is fully compatible with Ethereum, meaning developers can easily migrate their applications to Arbitrum.

Building on these strengths, Arbitrum has experienced broad adoption across diverse Dapps. In this article, we will delve into the Arbitrum Ecosystem, highlighting intriguing and essential Dapps available on it!

Top DApps Within the Arbitrum Ecosystem

Arbitrum stands out with its vast DeFi landscape, complemented by a variety of projects spanning bridges, tools, and NFTs. Here’s an overview of key projects driving innovation within the Arbitrum ecosystem:

Pendle

Pendle Finance is a yield derivative protocol on Ethereum and Arbitrum. It allows users to split interest-bearing assets (like eETH, pufETH, USDe) into principal tokens (PT) and yield tokens (YT).

- PTs represent the underlying asset and can be purchased at a discount, offering a way to lock in future value and avoid volatility.

- YTs represent the future yield of the asset, allowing users to speculate on potential interest rate changes.

This approach provides users with two key benefits:

- Increased Capital Efficiency: Splitting assets separates the principal from the yield, allowing for more strategic use of funds.

- Flexible Risk Management: Users can choose between the stability of PTs or the potential gains (and risks) of YTs.

Pendle Finance has attracted significant attention from the crypto community since its launch, by introducing the concept of separating principal and interest into the DeFi space. With the rise of the LST and LRT markets, Pendle’s TVL has also continued to grow. Pendle is currently the protocol with the highest TVL on Arbitrum, reaching 3 billion.

GMX

GMX is a decentralized spot and perpetual exchange that allows users to trade BTC, ETH, and other popular tokens with up to 50x leverage. It is built on the Arbitrum and Avalanche, and uses a unique liquidity pool design that provides low slippage and zero price impact trades.

GMX has two main tokens: GMX and GLP.

- GMX: The GMX token is the governance token of the GMX protocol. GMX token holders can participate in the governance of the protocol and earn a portion of the trading fees.

- GLP: GLP is the liquidity pool of the GMX protocol. GLP is made up of a basket of cryptocurrencies and provides liquidity for GMX’s trading.

GMX offers a compelling proposition for traders seeking a decentralized exchange with high leverage, low fees, and a unique liquidity pool design. The dual token system (GMX and GLP) incentivizes participation in both governance and liquidity provision, fostering a sustainable ecosystem for the GMX protocol. GMX is currently the derivative protocol with the highest TVL on Arbitrum, reaching $523 million.

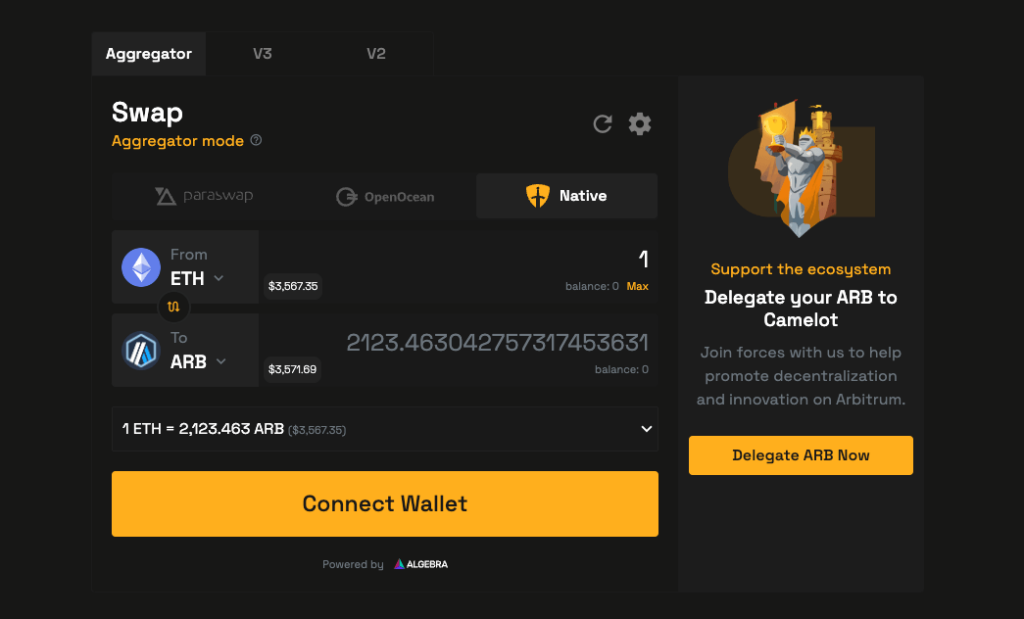

Camelot

Camelot is a highly flexible DEX built to support the Arbitrum ecosystem. Users can trade their desired assets on Camelot and earn rewards by providing liquidity.

Additionally, Camelot serves as the launchpad for Arbitrum native tokens, and has issued over 10 tokens to date.

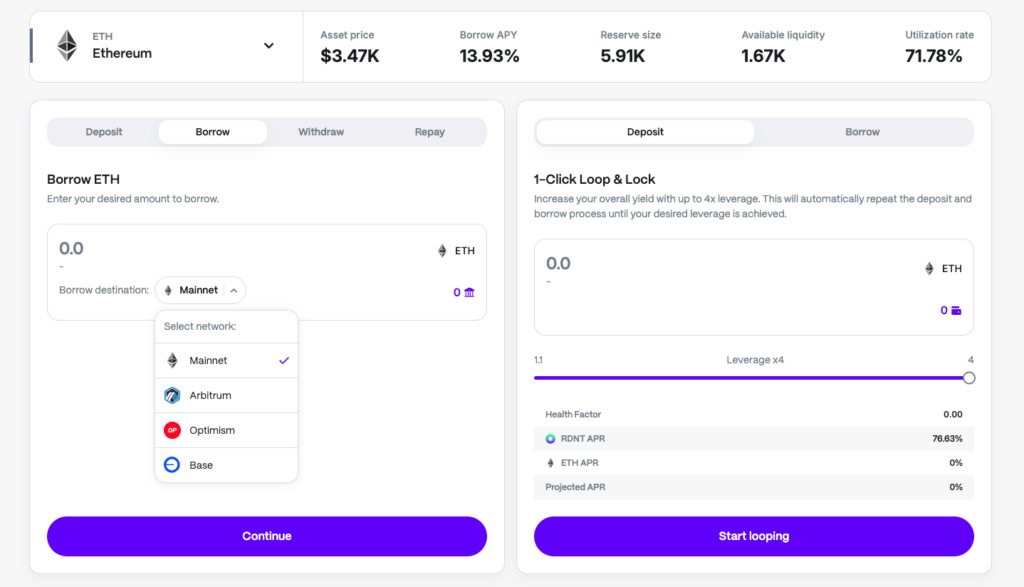

Radiant

Radiant is a lending protocol built on Arbitrum, Optimism, Ethereum, and Base. It aims to be the first omnichain money market where users can deposit any major asset on any major chain and borrow various supported assets across multiple chains.

Similar to other lending protocols, users can deposit tokens on Radiant to earn interest or use them as collateral to borrow other assets. Radiant currently supports 7 major assets, including ETH, WBTC, and various stablecoins.

What makes Radiant unique is that when users borrow tokens, they can choose a borrow destination, which allows the asset’s liquidity to be not limited to a single chain. For example, users can deposit ETH as collateral on Ethereum and borrow USDC on Arbitrum.

Radiant is currently the largest cross-chain lending protocol on Arbitrum, with a TVL of over $130 million.

Renzo

Renzo is a liquidity staking protocol based on EigenLayer. By restaking ETH or WETH on Renzo, users will receive ezETH and earn ETH staking rewards. In addition, users can also accumulate EigenLayer and Renzo Points, which will be used as the basis for future EigenLayer and Renzo airdrops.

Driven by the expectation of airdrops and the rising price of ETH, Renzo’s TVL has continued to rise, and it has become the restaking protocol with highest TVL on Arbitrum, reaching $115 million.

Space ID

Space ID is a decentralized universal naming service network that runs on top of blockchains (Arbitrum, Ethereum, BSC, and more). It is also a Web3 domain and identity management platform that allows users to register, exchange, and manage crypto-based domain names.

Users can register a .Arb domain by simply entering their desired domain name, selecting the registration period, and paying the fee in ETH. Currently, there are over 300K .Arb domains registered and over 250K owners.

XY Finance

XY Finance is a cross-chain bridge aggregator that operates on 20 EVM chains. XY Finance’s user-centric approach allows for easy token swaps between different chains, ensuring the best route and optimal prices for users.

Through XY Finance, users can effortlessly transfer assets to Arbitrum and explore the diverse Dapps on the Arbitrum ecosystem. This article will conclude with a detailed guide on how to use XY Finance!

How to Bridge Tokens to Arbitrum?

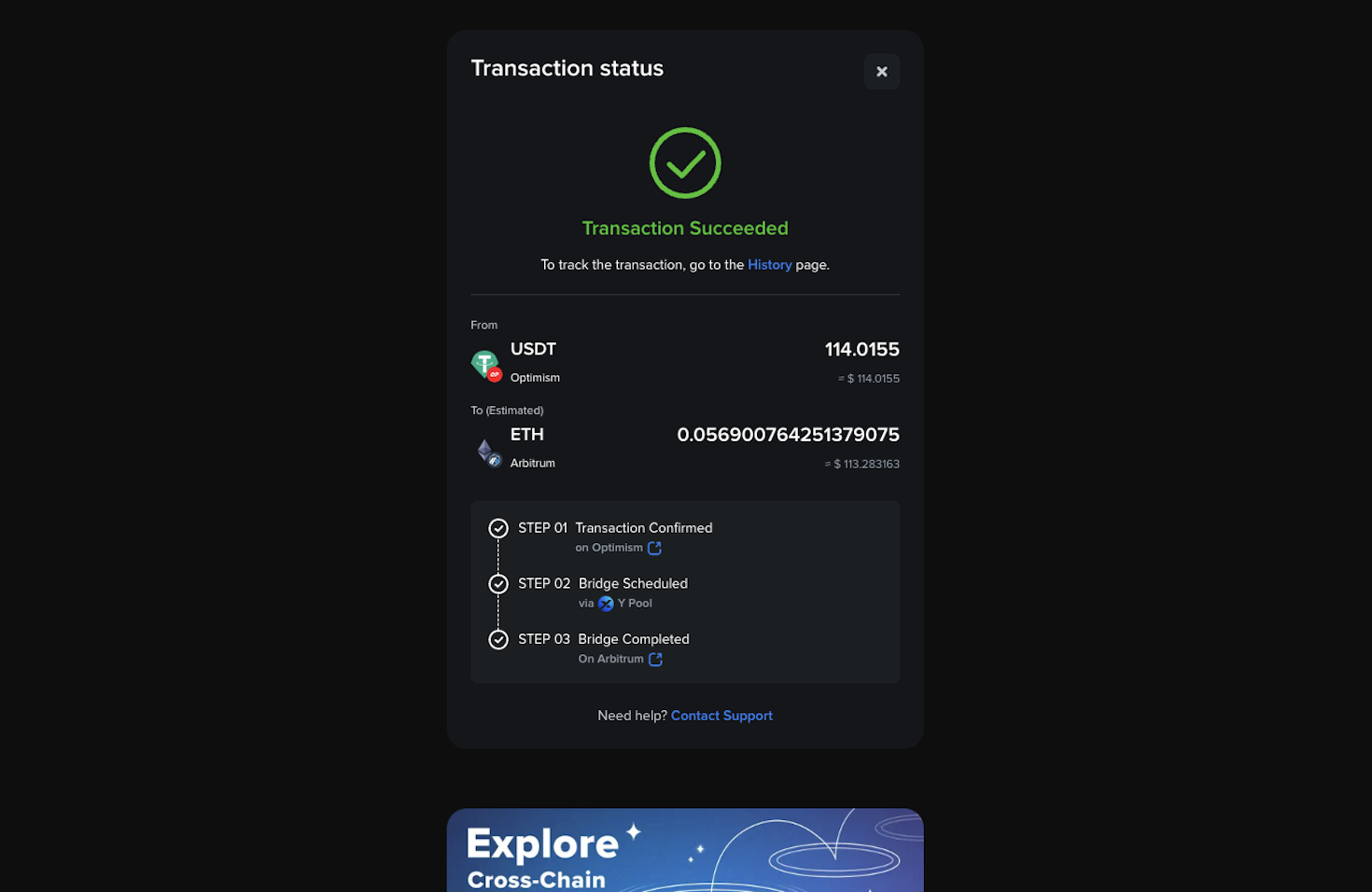

Previously noted, XY Finance offers a smooth and quick way to bridge assets to the Arbitrum. Don’t delay! Follow this straightforward guide to bridge tokens to Arbitrum now:

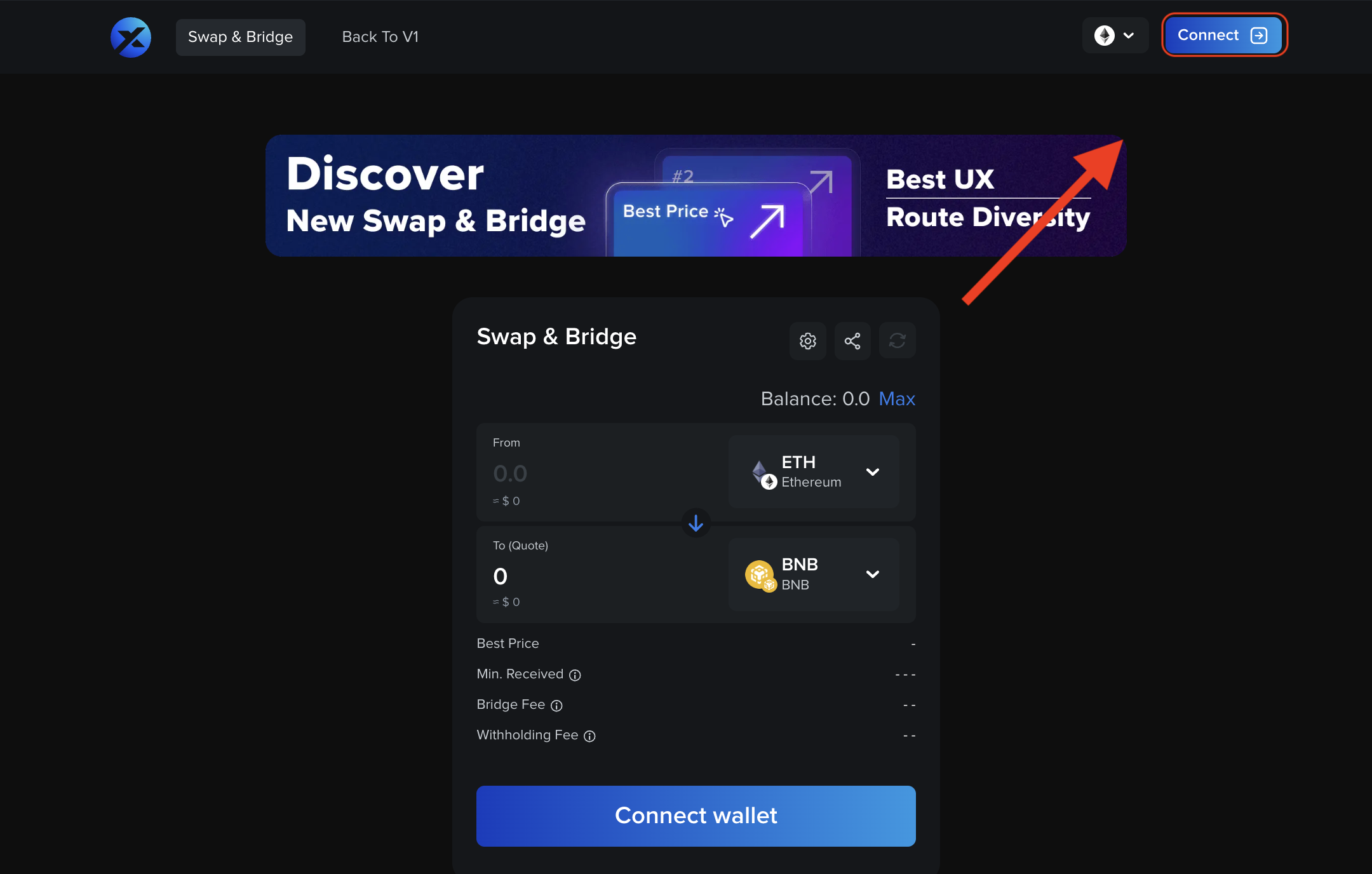

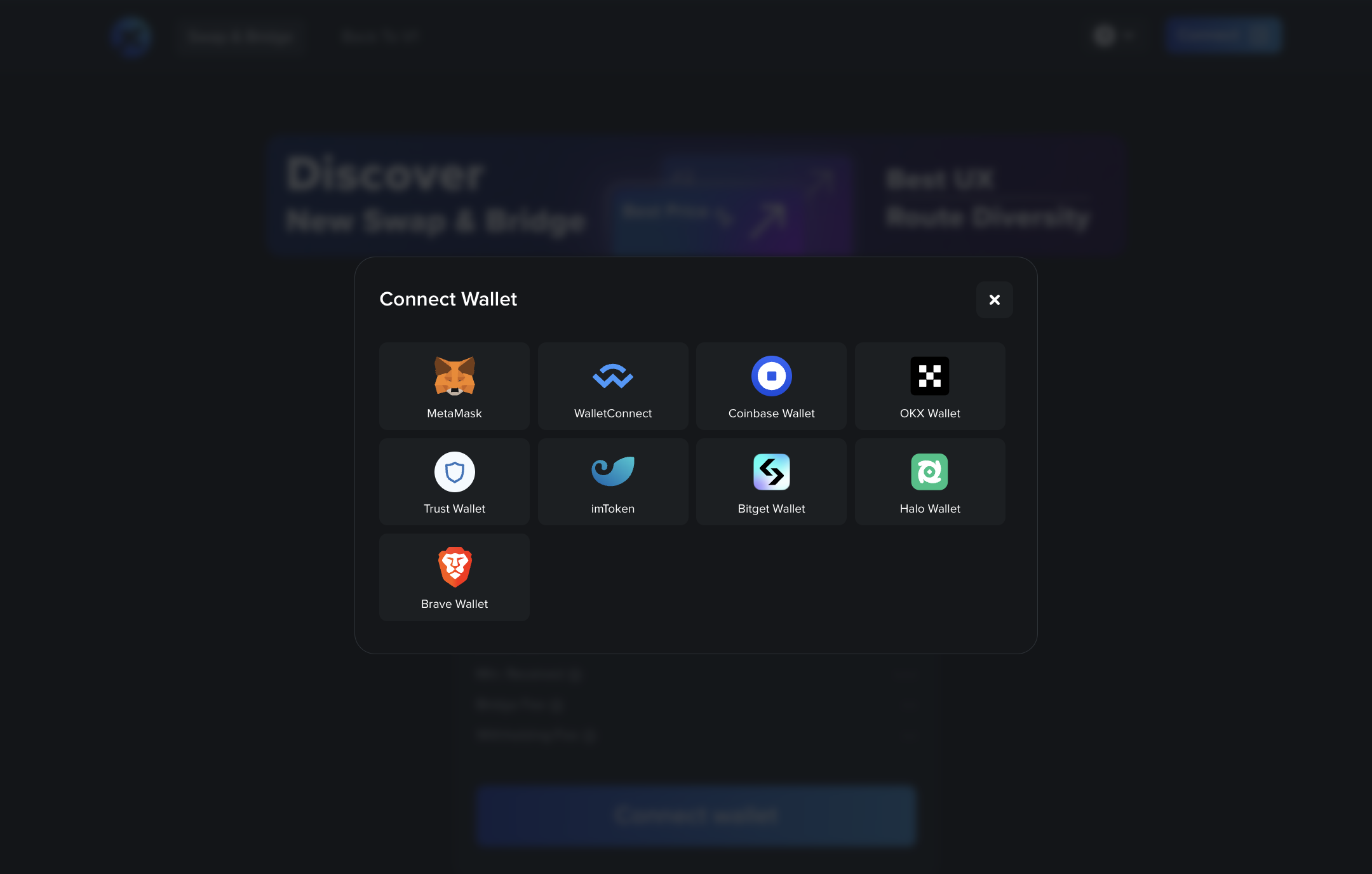

- Visit XY Finance and connect your Wallet.

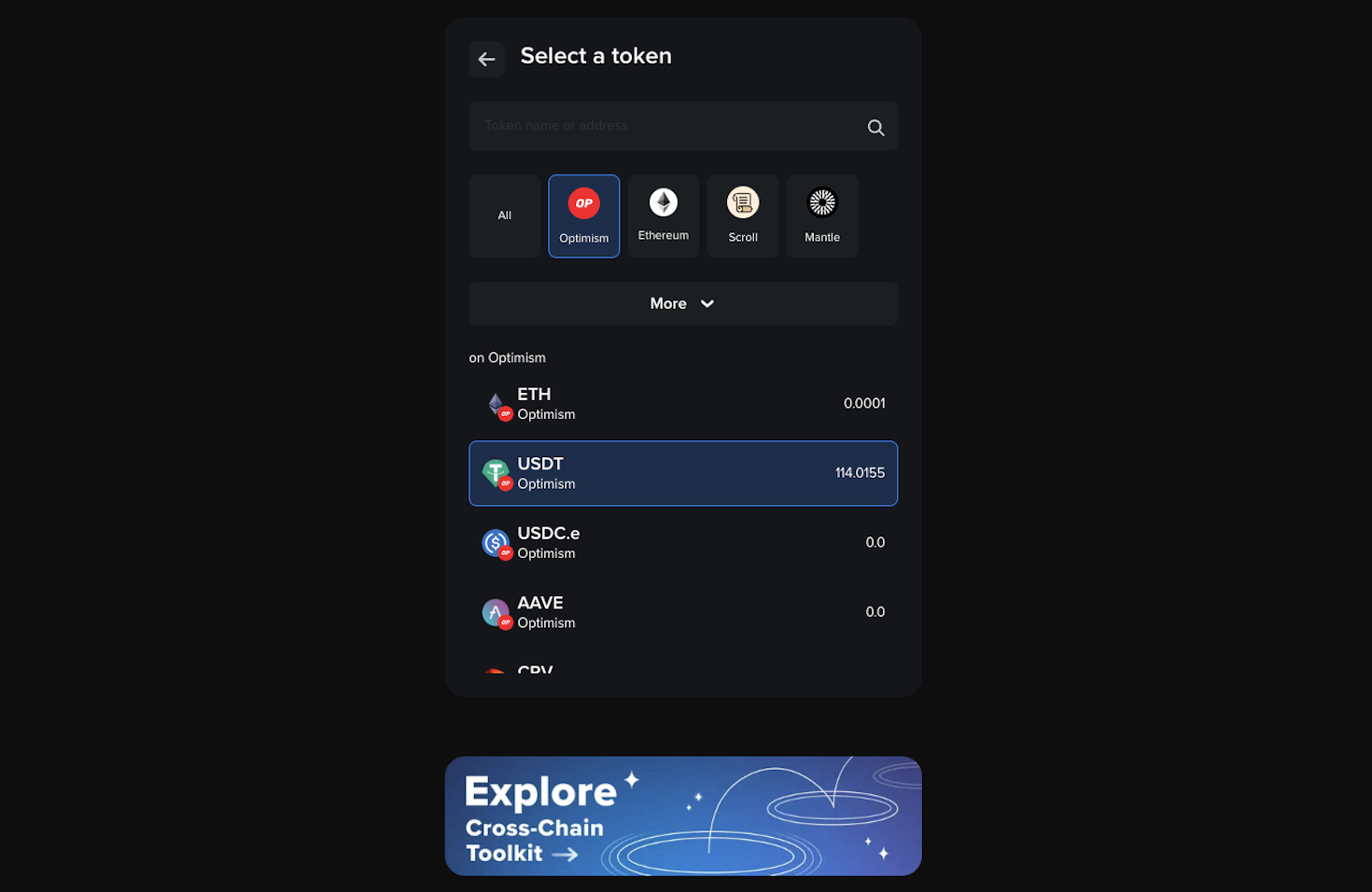

- Select the network you want to transfer tokens from (Ethereum, Polygon, Arbitrum, Avalanche, Optimism + 15 others).

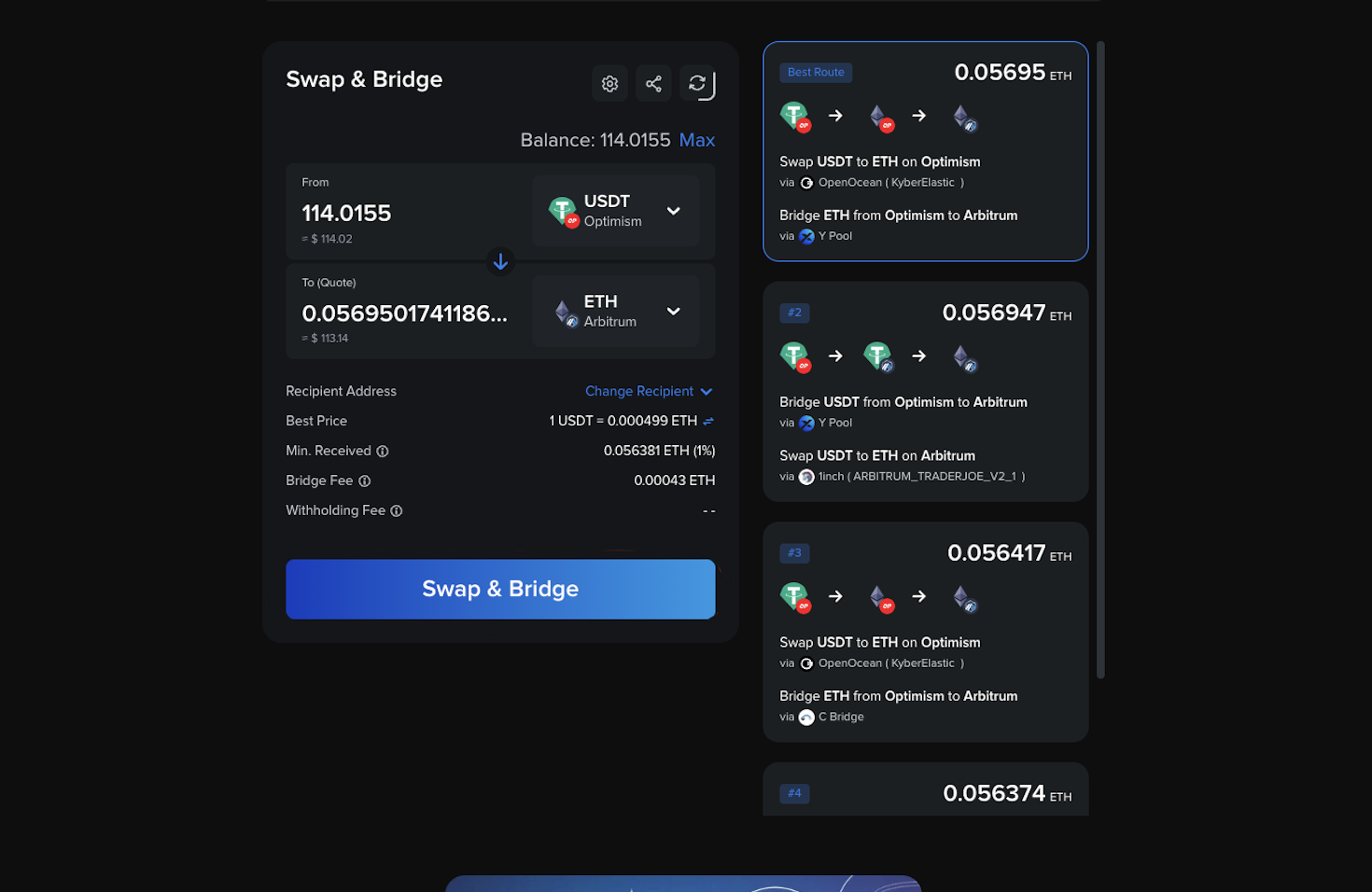

- Select the token you want to bridge from your network to Arbitrum and input the amount.

- Review and confirm the transaction. Your tokens will arrive in under 5 minutes.

(Encountering any problems while bridging? Check out our comprehensive tutorial.)

You’re all set! Start exploring the Arbitrum ecosystem now!

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form