Blast, an EVM-compatible Layer 2 (L2) known for its ‘Native Yield’ feature, claims to automatically compound assets deposited by users. What’s the story behind this emerging L2, and how did it accumulate over 2.3 billion in TVL in just 3 months? This article will answer all your questions about Blast!

TL;DR Increase Blast Airdrop Points in 3 Steps:

- Bridge assets to Blast (ETH, stablecoins)

- Invite friends to Bridge assets to Blast

- Interact with specific Dapps to earn “Multiplier” (Start from 4/2)

What is Blast? An Ethereum L2 with native yield

Before we dive into Blast, let’s talk about Blur first.

Blur, the leading NFT market founded by Pacman, has garnered significant attention in the crypto market over the past year due to its enticing airdrop rewards and continuously evolving trading features. Not only has it threatened OpenSea’s leading position, but it has also become the largest NFT market in terms of trading volume.

Last November, as Blur issued the second wave airdrop, Pacman announced the formation of a new team dedicated to creating an Ethereum L2 called Blast. Blast, which is based on Optimistic Rollup technology, will be EVM-compatible and is designed to generate passive income.

After three months of development and testnet trials, Blast’s mainnet officially launched on February 29, with the current TVL reaching an astonishing 2.3 billion.

How does Blast’s “Passive Income” mechanism work, and why has it attracted such a substantial amount of capital? The following sections will explain everything you need to know.

Why Blast? The L2 challenges that Pacman wants to solve

Before we discuss how L2 can create wealth for people, let’s first look at the problems that Pacman sees in the current competitive L2 ecosystem.

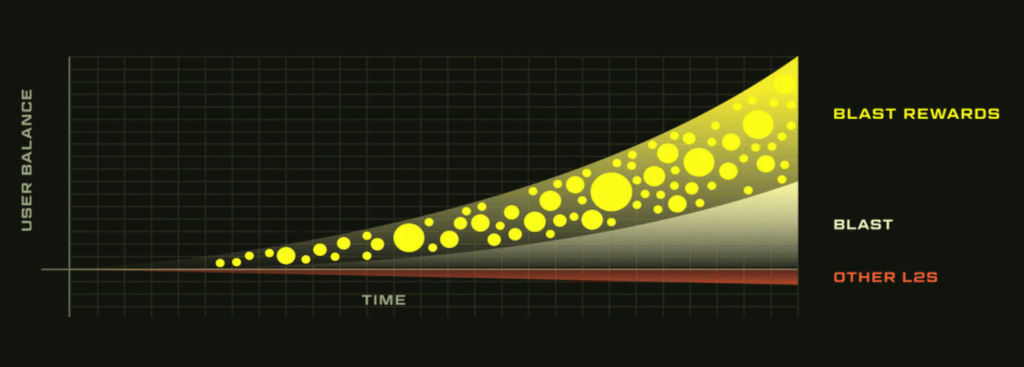

In traditional financial markets, people can earn risk-free returns by investing in financial products such as T-Bills (Treasury Bills) to avoid their assets from depreciating due to inflation. Ethereum also has a similar mechanism, where people can stake ETH to earn about 3-5% annual returns.

However, Pacman claims that the baseline interest rates of existing L2s are all 0%. If the assets deposited by users in various protocols cannot generate returns, they will continue to depreciate over time, such as the $100m of TVL in the Blur pool.

How does Blast generate yield for users?

To improve the financial efficiency of L2, Blast will generate yield for users through ETH staking and RWA protocol. In the beginning, Blast will deposit users’ ETH and stablecoins into Lido and MakerDAO, respectively, and provide 4% (ETH) and 5% (Stablecoins) interest rates.

Through this approach, users can not only avoid asset depreciation and earn additional income, but also have the opportunity to receive Blast airdrop in the future.

Under the dual incentives of airdrops and passive income, Blast accumulated over $2 billion in TVL on the eve of its launch.

Blast’s Pros and Cons

After having a preliminary understanding of Blast, let’s take a look at the current pros and cons of Blast.

Blast’s Pros:

- Accessible – Blast is EVM-compatible, making it easy for users and developers to port over to the network.

- Low Cost – Blast adopts optimistic rollups technology, which makes transaction costs much lower than on the Ethereum mainnet.

- Native Yield – Assets held on Blast will appreciate over time, reducing the impact of inflation.

- Potential Airdrop – After Blast is officially launched, previous users will have the opportunity to receive airdrop rewards.

- Developer Friendly – 100% of gas fee revenue will be provided to developers to promote ecosystem development.

- Well-Funded – Pacman announced that it has raised $40 million for the Blur ecosystem, with half of the funds being used to develop Blast. Blast is also backed by leading VCs Paradigm and Standard Crypto.

Blast’s Cons:

- Long Withdrawal Time – Since Blast is based on Optimistic Rollup, withdrawing through the Blast official bridge will result in a 7-day waiting period, during which users’ tokens cannot be quickly transferred. Additionally, the gas fee for a single withdrawal transaction currently costs nearly $100, which is quite pricey.

- Limited Ecosystem – Blast mainnet has just launched, with users having access to a limited number of protocols. However, Blast host a hackathon named “Blast Big Bang,” with many Dapp development teams participating. Consequently, the ecosystem of Blast may experience significant growth in the near future.

- Centralization Risk – Assets currently bridged to Blast are mostly deposited in Lido and MakerDAO. If these protocols encounter problems, it may lead to user asset losses.

Future Outlook: Emerging as a Strong L2 Competitor

Despite being in its early stages and having many issues to be addressed, Blast’s unique interest rate mechanism and potential airdrop have still attracted a large number of investors to deposit their assets in it.

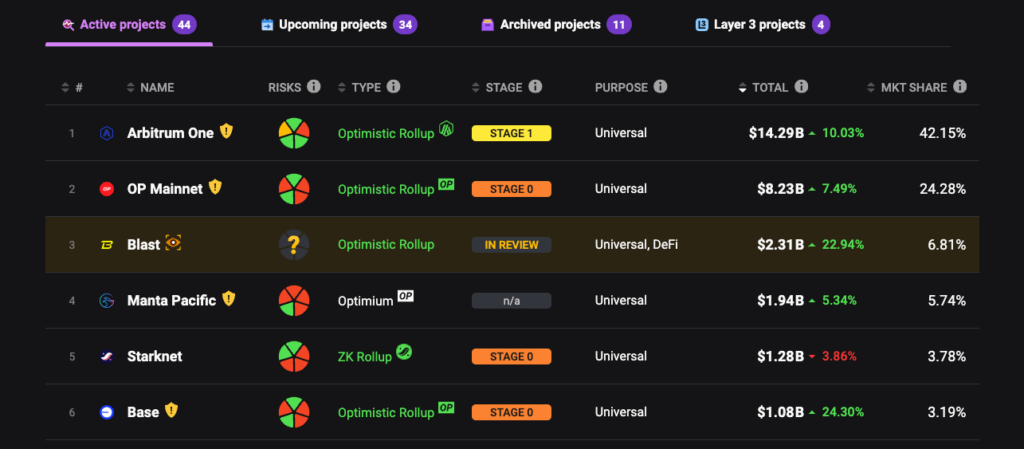

According to L2Beat, Blast has reached $2.3 billion in TVL within 3 months. Such an impressive capital-raising efficiency has made Blast the third largest L2 in terms of TVL, only behind Arbitrum, OP Mainnet.

If Blast can attract enough developers to build a complete and rich ecosystem after mainnet launched, it will prevent the gradual outflow of TVL once the incentive of the airdrop diminishes. In the future, Blast will become a strong competitor in the L2 war.

How to get Blast Airdrop Points?

Back to the topic that users are most concerned about, what activities are currently available on Blast? How can you increase your chances of winning an airdrop?

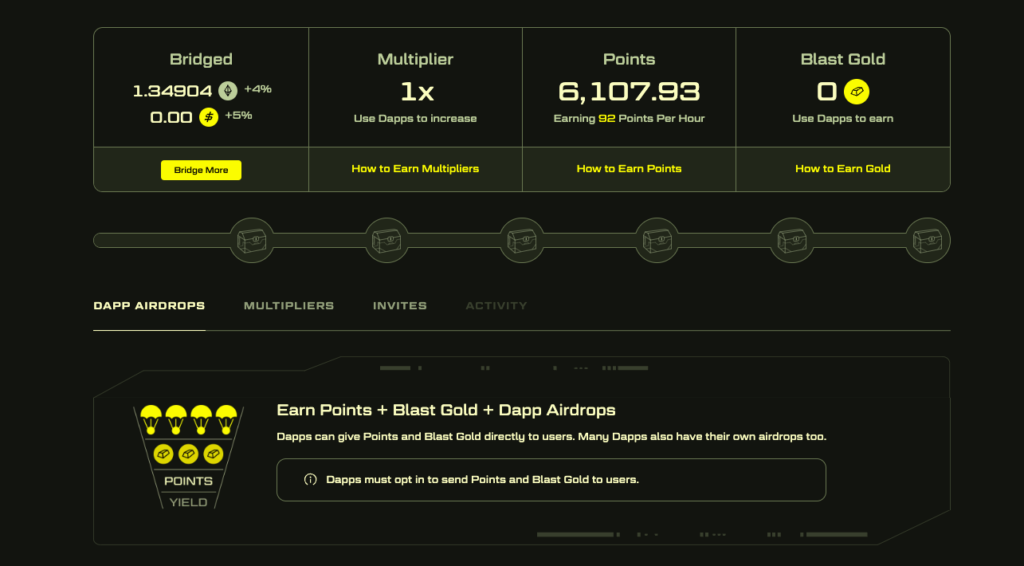

Since Blast is still in its early stages, users can accumulate Points to increase the amount of airdrops they can receive in the future. There are several ways to accumulate Points::

- Bridge assets to Blast (ETH, stablecoins)

- Invite friends to Bridge assets to Blast

In short, if you have idle ETH or stablecoins, you can cross-chain to Blast to accumulate points and invite your friends to join Blast.

Additionally, Blast’s documentation states that when users transfer ETH/WETH/USDB from their wallets to Dapps, those Dapps will begin accumulating Points based on the transferred assets. It is expected that Dapps will redistribute the earned Points to their users.

This implies that users can engage with Dapps on Blast without concern that transferring assets will impact the accumulation of their points.

How to get Blast Airdrop Multiplier?

Blast also features a “Multiplier” mechanism to expedite the accumulation of user points. The Blast team will gradually announce specific Dapps, and by transacting on these Dapps, users can obtain Multipliers!

According to the Blast website, 7 Multipliers are currently available, with a total of 14 planned, which can increase the Blast Point accumulation rate by up to 14 times.

Most Efficient Way to Maximize Your Blast Points & Multipliers

- Bridge to Blast via XY Finance: If you don’t have any assets or ETH as gas on Blast yet, start with XY Finance. Bridge & swap some ETH, WETH & USDB to Blast from 20+ chains to start increasing your Multiplier and earn extra points.

- Join DapDap’s Blast Gold Rush: Explore Blast treasure strategies, maximize your Blast Gold earnings!

- Spot Dexes 2x Multiplier: Swap any token to any token on Ambient Finance or Thurster

- Perp Dexes 2x Multiplier: Open a position on Particle Network

- NFTFi 2x Multiplier: Long or short NFTs on nftperp to get 2x multiplier

- SocialF 2x Multiplier: Mint a free Protoship NFT and explore the interactive interface of Spacebar playground.

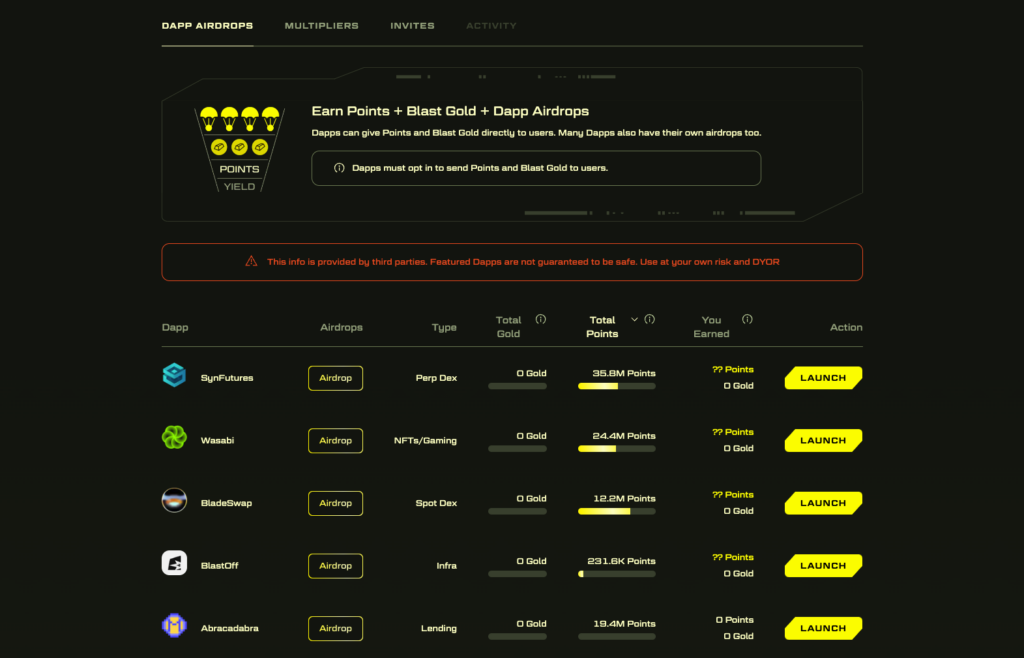

How to earn Blast Gold?

In addition to the airdrop distributed to users, Blast will also allocate 50% of the airdrop to Dapp teams, referred to as “Blast Gold.”

According to Blast Documentation, Gold distribution is manual. The Blast incentives committee will distribute Gold every 2-3 weeks and make a public announcement once Gold has been allocated.

Moreover, Gold is intended to serve as an incentive for Dapp growth. This means Dapps are expected to pass on 100% of any Gold they receive to their users. Therefore, by consistently engaging with popular Dapps on Blast, there’s an opportunity to receive Blast Gold in the future!

(Know more about Points & Gold! How to Earn them Efficiently?)

Blast Testnet is LIVE! The best way for developer to earn Blast Airdrop

On January 17th, the Blast team announced on platform X the official launch of the Blast Testnet. Concurrently, from January 17th to February 17th, they are hosting a grand hackathon titled ‘Blast Big Bang’. All Dapp development teams are welcome to register and participate.

The teams that come out on top will receive significant promotion from Blast upon the official launch of its mainnet in February. Additionally, these winning teams will be eligible to share in 50% of the rewards from the Blast airdrop. For more details, please refer to the link below!

P.S. Blast Big Bang has already ended.

How to cross-chain to Blast to earn Blast Airdrop?

Because Blast official bridge currently only supports bridging between the Ethereum mainnet & Blast, assets on other L1 or L2 chains need to be bridged to Ethereum before they can proceed to the next step.

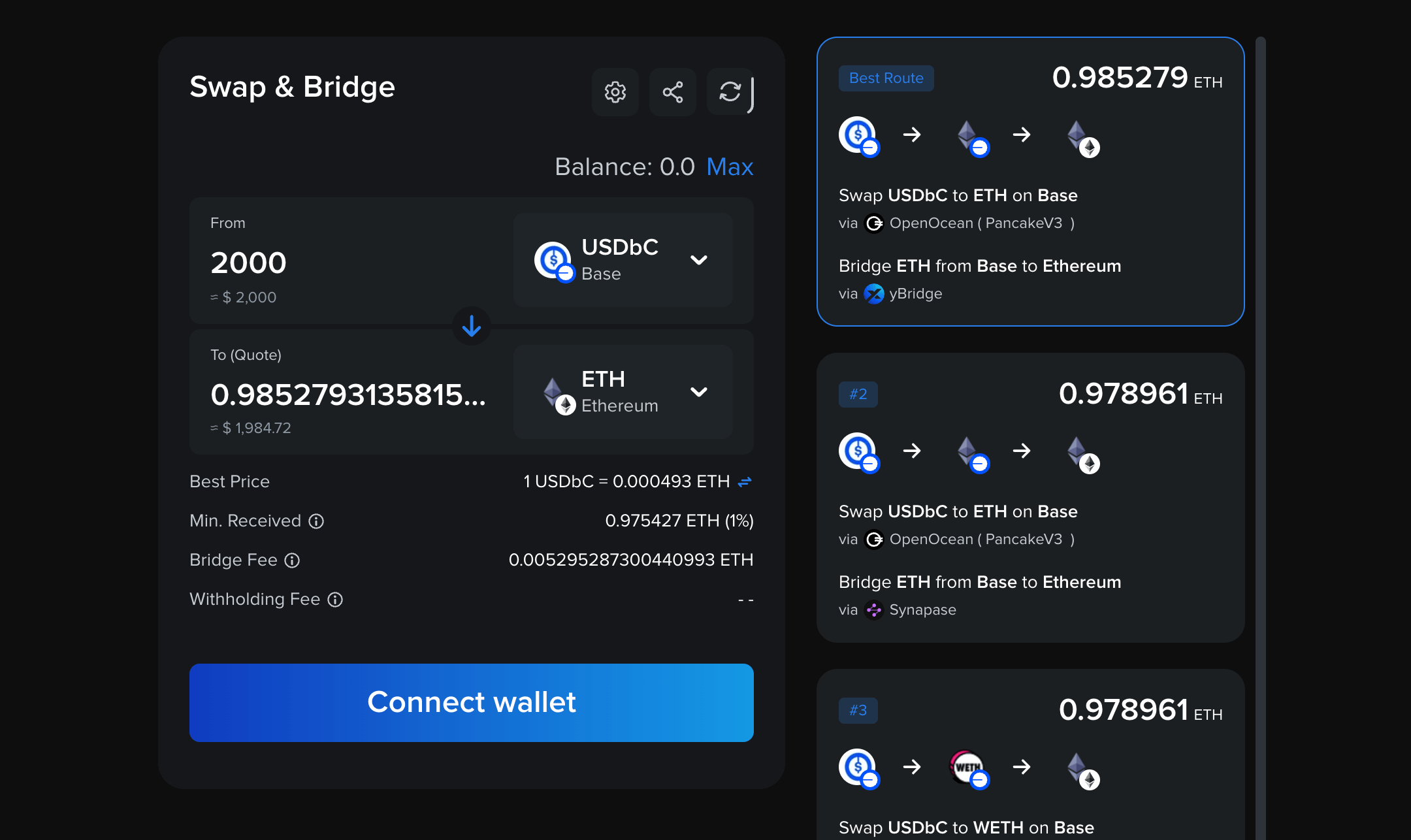

To resolve this issue, you can bridge your tokens from other chains using a third-party bridge service. We recommend XY Finance as your first and best choice, because it offers ultimate routing across multi-chains, making borderless and seamless swapping just a click away.

(Fully understand XY Finance: What is XY Finance? The cheapest cross-chain bridge aggregator that operates on 20 EVM chains)

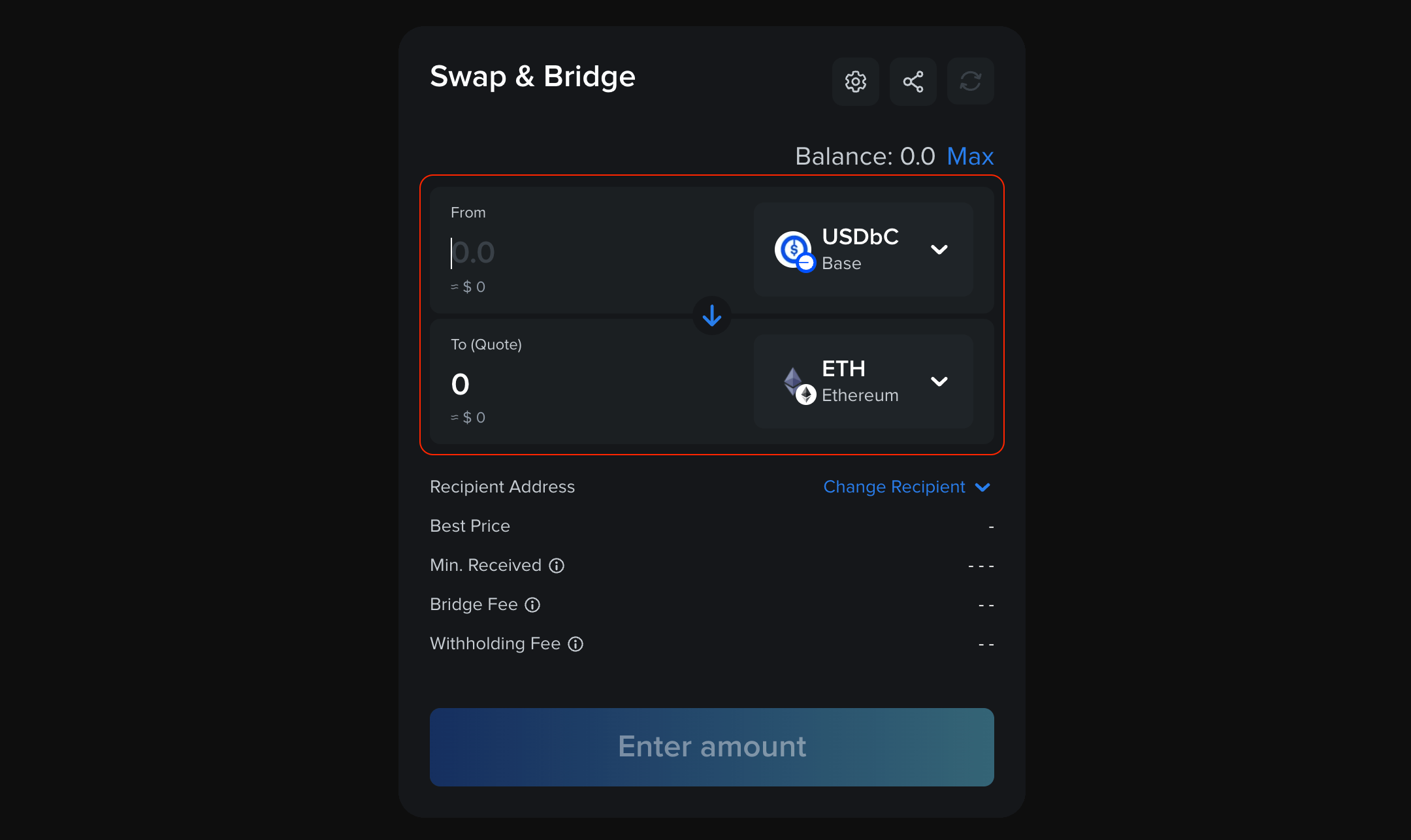

Don’t waste your time! You can now bridge tokens to Blast with the simple guide:

- Visit XY Finance and connect your wallet.

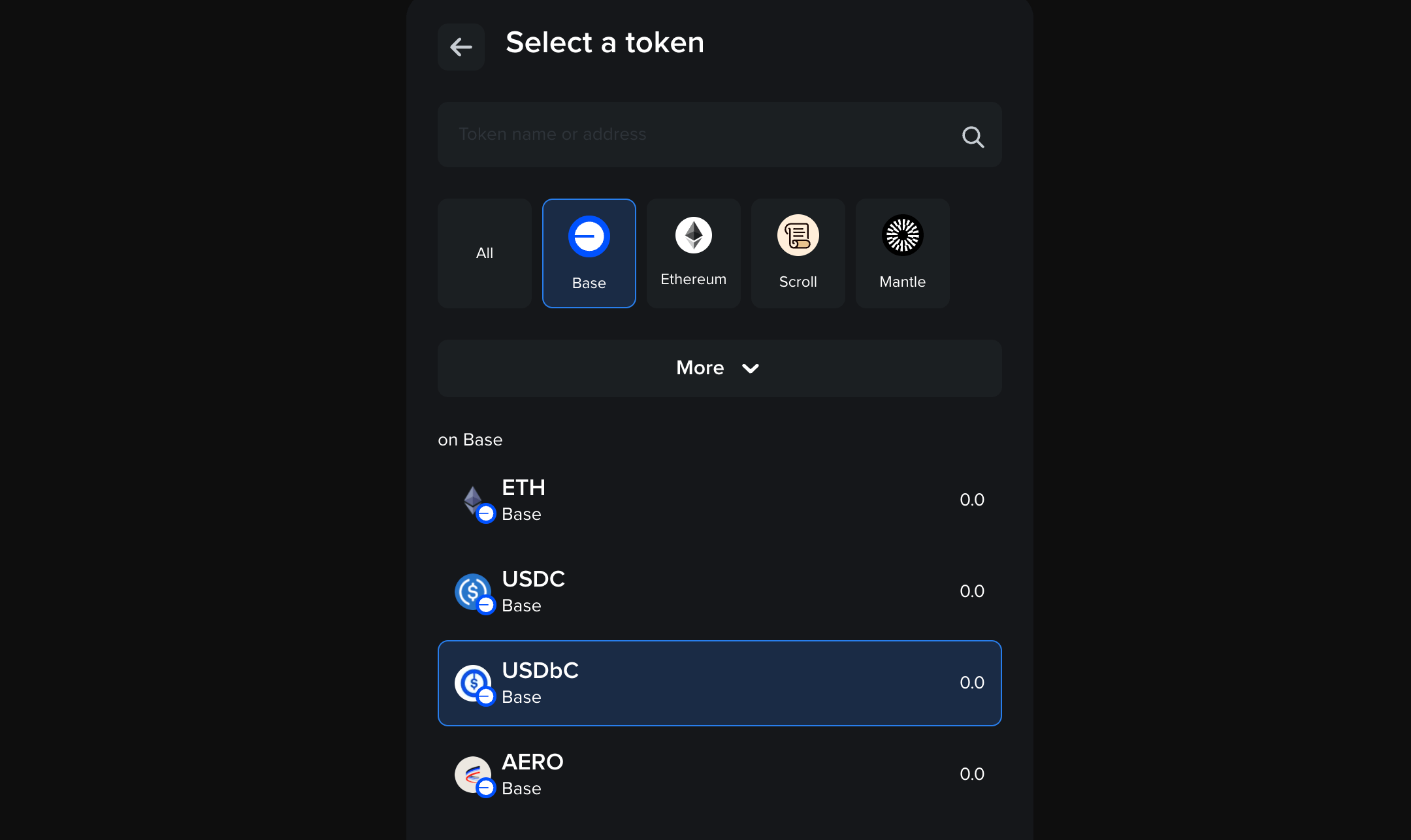

- Select the network you want to transfer tokens from (Base, Polygon, Arbitrum, Avalanche, Optimism + 15 others).

- Select the token you want to bridge from your network to Blast and input the amount.

- Review and confirm the transaction. Your tokens will arrive in under 5 minutes.

(Encountering any problems while bridging? Check out our comprehensive tutorial.)

Everything is ready, you can bridge your assets to Blast and patiently await the arrival of the AIRDROP!

(If you don’t know what interesting Dapps are on Blast, this article will take you to explore the Blast ecosystem: Exploring the Blast Ecosystem: Top 6 Dapps Introduction )

This article is not financial advice; make sure to do your own research.

About XY Finance

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges. With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance Official Channels

XY Finance | Discord | Twitter | Telegram | Documents | Partnership Form